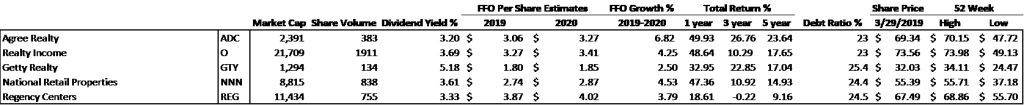

5 Best Performing Retail REITs

Agree Realty (ADC) is the top performing retail REIT with a total return over 5 years of 23.64%. ADC has more than tripled in size since 2015. Listed on the NYSE, ADC owns 645 Retail properties including 11.2 million square feet in 46 states, primarily free-standing assets. 51% of tenants are investment grade, with average remaining lease term of 10.2 years. 71% of annualized base rent (ABR) is from retail net lease, 29% from shopping centers and 6% from tenant ground leases. Top tenants include Sherwin Williams, Walgreens and Walmart. (Agree Realty, 2019)

Realty Income (O) Listed on the NYSE, O has paid an average annual dividend of 4.6% it’s 1994 IPO. O owns 5,797 retail properties with 9.2 years average remaining lease term, primarily free standing retail assets. 51% of tenants are investment grade. Occupancy of 98.6%. Annual NOI growth of ~1%. Top tenants include Walgreens, 7 Eleven and Fed Ex. O’s portfolio is predominantly comprised of retail assets (81.7%), but also includes industrial (12.1%), office (4.2%) and agriculture (2.0%). (O, 2019)

Getty Realty (GTY) GTY is listed on the NYSE and is the third most successful retail REIT with a five-year total return of 17.04%, and a dividend yield of 5.18%. GTY owns 930 assets in 30 states, predominantly free standing gas stations and convenient stores. 60% of ABR is in top 25 msas. GTYs portfolio has an average remaining lease term of ~10 years. Top 3 tenants are Global, United Oil and Chestnut Petroleum. GTY has essentially doubled in size over the last 10 years, and continues to aggressively pursue a growth strategy. (Getty, 2019)

National Retail Properties (NNN) NNN has averaged 14.93% total return over the last five years and produces a dividend yield of 3.61%. NNN focuses on single tenant, free standing, net lease retail properties, and owns 2,969 assets, 30.5 million square feet in 48 states, with an average portfolio occupancy of 97.9%. 7 eleven, Mister Car Wash and Camping World are NNN top tenants. (National Retail Properties, 2019)

Regency Centers (REG) REG is the largest shopping center REIT with 425 shopping center assets. REG has generated a total return of 9.16% over the last 5 years, and a dividend yield of 3.33%. REG’s portfolio has generated same store NOI growth of 3.4% consistently for each of the last seven years. The portfolio is 96.1% occupied, and encompasses 57 million square feet. 80% of REG’s properties are grocery anchored. Publix, Kroger and Safeway/Albertson’s are REG’s top tenants. (Regency Centers, 2019)

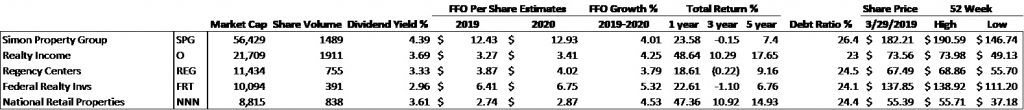

Largest Retail REITs by Market Cap

Simon Property Group (SPG) SPG, traded on the NYSE, is the largest retail REIT with a market cap more than double that of the second largest REIT in the subsector. Simon owns regional malls and has generated a total return of 7.4% over the last 5 years, with a 4.39% dividend yield. SPG’s portfolio has a total occupancy of 95.1%, and NOI growth of 1.7% in the first quarter of 2019. Most of SPGs portfolio is located in the US (79.5%). Top tenants include Macy’s, Gap, L Brands and JC Penney’s. (Simon Property Group, 2019)

Realty Income (O) As mentioned above Realty Income is the second most successful retail REIT in terms of five-year total return, and it is also the second largest retail REIT in terms of market cap at $21,709. A unique characteristic of O is that it pays a monthly dividend, as opposed to quarterly, which it has paid consecutively for more than 50 years. (Realty Income, 2019)

Regency Centers (REG) Regency Centers is also on both the top performing list, as well as the largest retail REIT list. REG owns shopping centers that are anchored primarily by grocers who report generating an average $650 of revenue per square foot. The REIT puts a great deal of emphasis on owning premium assets in highly desirable locations, in densely populated areas with above average income demographics. REG has successfully developed an alliance with grocers and retailers to scale into new markets. (Regency Centers, 2019)

Federal Realty Invs (FRT) The fourth largest retail REIT is also one of the oldest public REITs. FRT owns shopping centers primarily. The company was founded in 1962 and has paid dividends to shareholders every quarter for 57 years. The REIT owns 104 assets totaling 24 million square feet, predominantly retail. FRTs portfolio is similar to Regency Centers in terms of preferred demographics and population density. Portfolio property operating income grew 3.1% in the fourth quarter of 2018, yet the company still performs behind peers and the S&P 500 in terms of total return and dividend yield, with a five-year total return of 6.76% and a dividend yield of 2.96% FRT. (Federal Realty Invs, 2019)

National Retail Properties (NNN) As the fourth most successful retail REIT, and the fifth largest publicly traded retail REIT NNN’s strategy varies from peers somewhat in that they selectively target non-investment grade tenants who often pay higher rents, have higher rent growth over time and require a lower initial investment. NNN consistently outperforms peers and the S&P 500 in terms of total return. Dividend yields are slightly less than the REIT average of 4% and the retail REIT average of 4.64%. (National Retail Properties, 2019)