Summary

- REITs are pools of commercial or residential property that form an asset base against which units (similar to shares) are issued.

- When you buy REIT units, you own a slice of the income, expenses, gains and losses of the underlying properties.

- Publicly-traded REITs are SEC-registered, listed on exchanges and its units are liquid.

- Exchange-traded U.S equity REITs produced an annual average total return of 12.9% for the period of Dec. 31, 1978, through March 31, 2016[1].

- Before investing in REITs, it is vital to understand the various classes of REITs which are based on the type of assets, how they are traded and sectors they operate in.

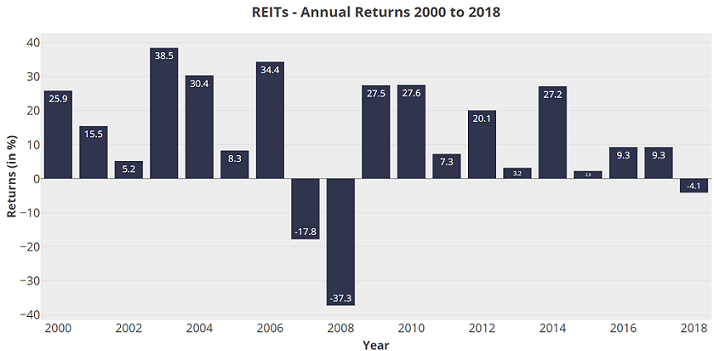

REIT Performance and Historical Returns

NAREIT reports that exchange-traded U.S equity REITs produced an annual average total return of 12.9% for the period of Dec. 31, 1978, through March 31, 2016[1]. This compares to an annual return of 11.64% from the Russell 3000 Index of stocks for the same period.

Source: Annual Index Values & Returns | Nareit

Other studies reinforce the conclusion that long-term REIT investments compare quite favorably with those from stocks. For example, Forbes reports that from 1977 to 2010, the average annual return for REITs was 12%, compared to 10% for the S&P 500.

A report from J.P. Morgan ranked various asset classes for the past 20 years and ranked REITs as the top performer with an annualized return of 9.9%.

Things to Consider when Investing in REITs

If you are thinking about diversifying into REITs, consider these investment tips.

Due Diligence

Before investing in a REIT, you should research its past performance and its current holdings. The most important consideration is earnings growth, which stems from increasing rents, higher occupancy rates, lower expenses and new business. Also check out the track record of the management team, and see if they have had success redeveloping underutilized properties, thereby increasing demand and revenues.

An industry resource for researching REITs is the monthly NAREIT REITWatch. It contains a wealth of data about all publicly traded North American REITs.

Sector Considerations

A REITs investment risk ties directly to its sector of operation. For example, the growth of online commerce will continue to challenge retail REITs. On the other hand, the aging population will stoke demand for health care REITs. Another example of a risk to evaluate is the rise of lodging alternatives such as Airbnb and their impact on the hotel sector. Finally, sectors are vulnerable to macroeconomic movements. For example, about a quarter of all publicly-traded REITs belong to the retail sector and therefore are susceptible to weakening economic trends and falling consumer confidence.

Rent Increases

For many years, rent increases were depressed due to limited wage growth and subdued inflation. Both of these factors are currently on the rise, creating a positive momentum for rent increases. However, you should also check for changes in supply vs demand. In the last year, several sectors have seen an increase in the supply overhang that limits rent increases.

Other Risks

REIT investors should consider these other risks:

- Nontraded REITs can show price volatility and might be vulnerable to fraud.

- Early redemption fees and restrictions might be excessive.

- Management fees might be excessive.

- Private and non-traded REITs might not fully specify the properties they own, greatly complicating an investor’s risk assessment.

REIT Yield and Investor Considerations

The distribution yield of a REIT is its latest dividend, expressed on an annualized basis and divided by unit price on the distribution date. The true yield is the 12-month distribution divided by the net asset value, thereby smoothing out the impact of occasional special dividends. Total REIT returns consist of their yield and their capital appreciation.

Investors should examine a REIT’s cash available for dividends and cash flow from operation, since higher numbers cut the risk of omitted dividends. You might want to look askance at dividends that include a large return of capital due to depreciation, since these are a non-cash expense and might not be sustainable, introducing an element of risk.

Pros and Cons of REIT Investing

Pros

The chief reasons to invest in REITs include:

- Steady monthly income.

- Outperforms investments in direct real estate and stock indices.

- Increases diversification of your investment portfolio, thereby lowering overall risk.

- Properties are professionally managed.

- Any size investment.

- Highly liquid investment (publicly-traded REITs).

- No property management by investor.

- You can pledge or short units.

- Easy to hold in retirement accounts.

Cons

These are some reasons why you might hesitate to invest in REITs:

- Passive investment, no control over portfolio.

- 90% distribution of income means only 10% available for growth.

- Nontraded REITs are illiquid.

- Private REITs are illiquid, opaque and restricted to accredited investors.

- Sectors susceptible to macroeconomic movements.

- Time and energy required to monitor REIT performance.

- Not appropriate for short-term investors.

- May have high management fees and commissions.

Sources

- https://www.reit.com/news/blog/market-commentary/comparing-average-reit-returns-and-stocks-over-long-periods