Summary

- Mortgage REITs (mREITs) own commercial and residential mortgage securities collateralized by real property.

- Mortgage REITs act as a link between capital and real estate markets and are significant drivers of industry growth.

- Residential mREITs help finance more than 1.8M homes in the US. (com, 2019)

- 35 mREIT constituents are publicly traded on US exchanges, including 22 residential financing mREITs and 13 commercial financing mREITs with a total market cap of $74.2 Billion.

- Residential mortgage REIT market cap: $51.8B

- Commercial mortgage REIT market cap: $22.4B

- 2019 YTD average mortgage REIT dividend yield: 10.61% vs. 4.13% for the broader REIT sector.

What are Mortgage REITs?

Mortgage REITs (mREIT) generate returns for shareholders through the origination and acquisition of mortgage backed securities (MBS), and through effective management of interest rate risk. MBS are income producing assets collateralized by real property. MREITs borrow to acquire the MBS and manage the lending vs. borrowing spread to generate returns.

MREITs are managed either internally or externally. Internal management requires REITs to assemble a management team with a great deal of experience and expertise in mortgage backed securities and interest rate risk management. External management allows mREITs to leverage the expertise of global investment management firms to manage assets and risks. There are varying opinions on which is most effective, including a perceived conflict of interest by external managers and limited fee disclosure requirements.

Mortgage REITs are typically classified by their predominant investment strategy, based on which type of assets they lend on, either commercial or residential. Both are important to the overall economy as they act as links between investment capital and borrowers. Residential mortgage REITs, however, have historically outperformed commercial mREITs. The fundamentals of each are detailed below.

Residential mREITs

Residential mREITs help finance more than 1.8 million homes in the US. (REIT.com, 2019) Most residential mortgage REITs allocate significant portions of their portfolios to agency mortgage backed securities, which are backed by government guaranty’s, and then diversify with a variety of other higher yielding loans and securities.

Types of investments made by residential mREITs include the following:

- Agency MBS are securities guaranteed by the federal government. The securities are comprised of groups of loans packaged together and sold as securities with payment guaranties provided by the federal government through Fannie Mae, Freddie Mac and Ginny Mae. While there is little default risk associated with these securities, there is significant on-going interest rate risk.

- Non-Agency MBS are groups of whole loans packaged together by credit profile and securitized. These MBS are not guaranteed by the federal government. Non-agency MBS may either be a group of whole loans originated and packaged by the REIT itself or may be originated and securitized by another party and acquired on the secondary market.

- Whole loans may be acquired from other lenders or originated by the REIT itself, though it’s rare for a residential mREIT to act as a direct lender. Whole loans may be packaged into securities and sold in tranches according to underwritten credit profiles or they may be held on the REITs balance sheet.

The above are just a few of the common components of a residential mREIT portfolio, there are many ways for REITs to invest in residential mortgages, including subclasses of each of the above, and participation with other lenders on large loans or securities. Most residential mREITs are hybrid REITs which own both agency and non-agency MBS.

Commercial mREITs

Commercial mREITs generate income by lending on income producing commercial real estate through mezzanine financing, construction loans, whole loans and a variety of other securities. There are three primary means of acquiring assets as a commercial mREIT:

- Acquiring MBS originated and securitized by other lenders on exchange markets.

- Direct lending, which occurs when the mREIT originates or purchases whole loans to be held on the company’s balance sheet.

- Conduit lending, which involves originating, packaging and then selling loans through securities such as CMBS.

Types of investments made by commercial mREITs through the channels listed above include the following:

- Commercial Mortgage Backed Securities (CMBS) are loans that are originated, packaged then sold in tranches based on the risk profile of the underlying assets. CMBS are collateralized by commercial real estate assets.

- Mezzanine Financing and Preferred Equity are riskier forms of commercial real estate lending but tend to generate greater returns. The mREIT contributes equity or debt in exchange for a preferred rate of return which is traditionally more in line with equity returns, than debt returns.

- Commercial Whole Loans are similar to residential whole loans, they may either be held as balance sheet loans or securitized and sold. Whole loans may also be sold on the fourth market between institutions without securitization.

MREITs have the same REIT requirements as equity REITs in that they must distribute 90% of taxable income, at least 75% of gross income must come from qualified real property or debt secured by real property and 75% of investments must be invested in real estate, mortgages, other REITs or government securities. (ULI, 2019) MREITs can be an excellent source of income. Residential mREITs have generated an 11.5% dividend yield over the last 12 months, and commercial mREITs have generated a 7.93% dividend yield over the same period, both sectors have generated similar dividend yields for the last five years or more.

Interest rate risk management, as mentioned before, is critically important to mREITs. While most REITs are subject to interest rate risk due to high levels of debt, mREITs have a debt ratio more than double that of equity REITs, averaging 85.5% with an interest coverage ratio of .20. Equity REITs have an average debt ratio of 34.1% and interest coverage of 4.42.

Pros and Cons of Mortgage REITs

Pros

- MREITs generate superior dividend yields of 10%-12% traditionally and can be an excellent source of income.

- Mortgage REITs act as a link between capital and real estate markets and are significant drivers of economic growth.

- The current interest rate environment and stable forecast are favorable for mREITs.

Cons

- Mortgage backed securities, both residential and commercial, are complex in nature.

- Total returns tend to lag the broader market, and REIT sector.

- MREITs are extremely sensitive to a rising interest rate environment.

2019 Outlook for Mortgage REITs

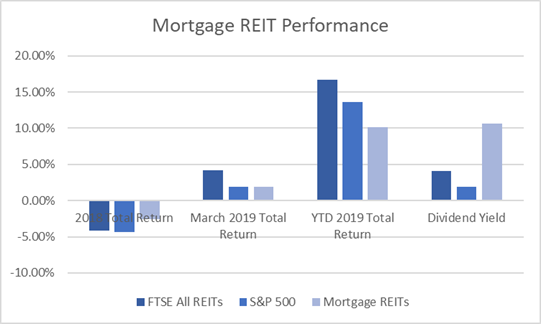

Mortgage REITs tend to underperform the broader REIT sector and the S&P 500 in terms of total return as shown in the table below. However, mortgage REITs consistently generate dividend yields in the 10%-12% range, or roughly three times the REIT sector average of 4% (NAREIT, 2019) and six times that of the S&P 500 average of 2.09% (YCharts, 2019).

Interest rate sensitivity is the greatest risk for REITs. Rates are expected to remain relatively stable for the remainder of the year. Some are speculating that the Fed may cut interest rates in 2020 (Kiplinger, 2019), which would likely lead to an uptick in prepayments for some of the mortgage REITs but would ultimately allow for continued growth, and stronger total returns in the long term.

(NAREIT, 2019)

(NAREIT, 2019)

The broader economic outlook bodes well for continued dividend yields in line with historical averages. Total returns may be more challenging to gauge but will likely perform slightly better than 2018 where fear of an on-setting recession lead to some volatility in stock prices at year end. Many economists are calling for a more modest deceleration of the economy this cycle, as opposed to a deep recession, which would be favorable for mREITs, as it would require only modest changes to risk management and asset management strategies.