Key Takeaways

- Apple Hospitality REIT, a Virginia corporation founded in 2007, invests in high-quality and strong brands of room-focused hotels across the U.S. markets, such as Marriott®, Hilton®, and Hyatt®. They don’t own any foreign assets and they only focus on one sector.

- Apple Hospitality REIT’s portfolio as of June 30, 2021, consists of 29,753 rooms in 232 hotels across 35 states. Specifically, they own 124 Hilton hotels, 103 Marriott hotels, 3 Hyatt hotels, and 2 independent hotels.

- They hire 17 third-party, unaffiliated property managers to operate its hotels to maintain its REIT status. The management fee has a variable fee structure which accounts for about 2.5% to 3.5% of the gross revenues.

- They started publicly trading on May 18, 2015, on the New York Stock Exchange with the ticker symbol, NYSE: APLE.

- In FY 2019, 96% of their investment portfolio is enrolled in the U.S. EPA’s Energy STAR program.

- Data from Seeking Alpha show that about 80% of Apple Hospitality REIT’s stockholders are institutional investors. Only about 13% comes from public investors.

- In FY 2020, total revenue dropped to almost 50%, net loss was incurred, and FFO, RevPAR, and Occupancy hit an all-time low for the past 4 years. In 2021, the Company’s financial numbers are slowly recovering.

- Since March 2020, the Company has suspended its monthly distributions. It only came back on the first quarter of 2021 where the quarterly distributions of $0.01 per common share started.

Their headquarters office is located at 814 East Main Street Richmond, Virginia, U.S.A.

Company Background

Apple Hospitality REIT, Inc. is a SEC-registered Virginia corporation that was founded in 2007. But together with its preceding companies from Apply Hospitality Two to Apple REIT Ten, Apple Hospitality REIT has been in the lodging industry for about 20 years already. They mainly invest in high-quality and strong brands of room-focused hotels across the U.S. markets, such as Marriott®, Hilton®, and Hyatt®.

Apple Hospitality REIT, Inc. is a SEC-registered Virginia corporation that was founded in 2007. But together with its preceding companies from Apply Hospitality Two to Apple REIT Ten, Apple Hospitality REIT has been in the lodging industry for about 20 years already. They mainly invest in high-quality and strong brands of room-focused hotels across the U.S. markets, such as Marriott®, Hilton®, and Hyatt®.

The Company highly capitalizes on the strong reservation systems, loyalty programs, award-winning customer service, innovative design, and modern amenities. They don’t own any foreign assets and they only focus on one sector. Their business model strategies include:

-

- Own upscale hotels with the best lodging brands and work with outstanding hospitality management teams

- Maximize disciplined capital allocation and maintain financial flexibility with low levels of debt

- Reinvest consistently on their hotels

REIT Type Summary

Public and Traded REIT

The Company started publicly trading on May 18, 2015, on the New York Stock Exchange with the ticker symbol, NYSE: APLE. As a SEC-registered company, investor filings are easily accessible by the public.

Even before Apple Hospitality REIT started trading in 2015, previous affiliated companies have long operated as a REIT investing in the lodging sector. It started in 2001 with Apple Hospitality Two, followed by Apple Hospitality Five (2003), and Apple REIT Six (2004). Afterward, Apple REIT Seven to Apple REIT Ten merged with Apple Hospitality REIT.

Equity REIT

Apple Hospitality REIT owns their hotel room properties and leases them out to tenants. They work with third-party and unaffiliated hotel management companies. They pay out dividends to their investors from rental income.

Lodging Sector

The Company has real estate investments in the lodging or hospitality sector. They own and indirectly manage upscale hotel rooms under strong brands. Their total revenue comes from the room, food, and beverage services. Hotel operating costs, on the other hand, come from administrative/management costs, sales, marketing, utilities, repairs, maintenance, and franchise fees.

Apple Hospitality REIT’s hotel rooms have a sustainable advantage. The use of LED lighting, energy management systems, smart irrigation systems, and energy/water conservation guidelines not only protects the environment. It also reduces operating expenses. In FY 2019, 96% of their investment portfolio is enrolled in the U.S. EPA’s Energy STAR program.

What the REIT Fund Invests In

Upscale and Branded Room-Focused Hotels

Courtyard by Marriott is one of Apple Hospitality REIT’s real estate investments (Source: Marriott)

Apple Hospitality REIT invests in strong brands within the hotel industry — like Marriott, Hyatt, and Hilton. Their business model favors efficient hotel operating models and strong consumer preferences. For that, property management plays a big role in customer attraction and satisfaction. The Company hires third-party, unaffiliated property managers to operate its hotels to maintain its REIT status. The management fee has a variable fee structure which accounts for about 2.5% to 3.5% of the gross revenues.

The U.S. Market

Source: Investor Presentation (August 2021)

Their real estate properties are spread out across 35 states in 84 U.S. markets. The Company makes use of its connections to gain vendor contracts and to expand franchising networks.

Investing Strategy for Seasonal Variability

The hotel industry has its seasonal variability with the 2nd and 3rd quarters having greater revenues compared to the 1st and 4th quarters. But despite the fluctuating performance, the Company has to make consistent distributions (more so in the pre-pandemic days). To even out and make consistent distributions, they may use a revolving credit facility. But today in the pandemic, the Company has suspended monthly distributions since March 2020.

As of June 30, 2021, the Company has an outstanding mortgage debt of approximately $450.7M with a total of 28 properties in collateral. The effective interest rates range between 3.40% to 4.97% and the maturity dates are from September 2022 to May 2038.

REIT Investment Portfolio

For FY 2020, the Company’s net real estate investments were approximately $4.7B. Recent data from June 30, 2021, update the amount to $4.4B. Apple Hospitality REIT’s portfolio as of June 30, 2021, consists of 29,753 rooms in 232 hotels across 35 states. Specifically, they own 124 Hilton hotels, 103 Marriott hotels, 3 Hyatt hotels, and 2 independent hotels.

Source: Apple Hospitality REIT 10-Q Report (Q2 2021)

These hotels are managed by 17 hotel management companies with separate management agreements — none of which are affiliated with Apple Hospitality REIT. Most of these hotels are located in high-end suburban places, followed by urban areas. According to their Q2 2021 report, upscale and suburban hotels outperform luxury and urban hotels throughout the hospitality industry. Together, suburban and urban hotels make up 79% of the Company’s portfolio.

Source: Investor Presentation (August 2021)

About a quarter of their REIT investment portfolio is spread out across airports, interstates, resorts, and small metros.

Sales and Acquisitions

The Company earns revenues from daily hotel operations. But from time to time, they may assess whether selling some properties will bring more value to their investment portfolio. As of August 30, 2021, 547 hotel rooms are held for sale worth $159.8M while 837 rooms worth $227.7B were acquired.

Proceeds from property sales go to payments for the revolving credit facilities’ borrowings, further acquisitions, and other general purposes.

Investment Ownership

Data from Seeking Alpha show that about 80% of Apple Hospitality REIT’s stockholders are institutional investors. Only about 13% comes from public investors.

Screenshot taken from Seeking Alpha

According to CNN Business, these are the top 5 institutional investors of Apple Hospitality REIT:

- The Vanguard Group, Inc. (~$446M)

- BlackRock Fund Advisors (~$232M)

- T. Rowe Price Associates, Inc. (~$129M)

- SSgA Funds Management, Inc. (~$122M)

- Invesco Advisors, Inc. (~$113M)

Lastly, the remaining category of investors is from insiders such as the Company’s Board members.

REIT Performance

Historical Price Chart

Source: Seeking Alpha

Apple Hospitality REIT went public on May 18, 2015, with an initial public offering (IPO) of $18 per share under the ticker symbol NYSE: APLE. Since then, it has had its ups and downs but has so far not yet soared past its IPO. The REIT’s price drastically dropped in the first quarter of 2020 because of the COVID-19 pandemic. However, it recovered by the last quarter of 2020. Today, the price is back up comparable to their 2019 market run.

If you entered the market during the Company’s IPO, you’ll have a capital loss of about negative 18% with its current price at $14.73. But this is good news for investors who’re still planning to invest in APLE. It just means that the past 5 years didn’t matter in terms of the market price.

Key Performance Metrics Through The Years

Then again, a REIT’s historical price doesn’t paint the whole picture. You have to also run the numbers and see how the company managed its investments through the ups and downs of the business cycle. Here are 6 of the critical parameters you should look at to measure the company’s operating performance:

- Total Equity — this represents the company’s net worth value. It tells us how big and valuable the company is in the market.

- Total Revenue —this parameter tells us how profitable the company is. How much does the company earn in doing its business?

- Net Income or Loss — how much did the company earn or lose from its revenues and debts

- Funds from Operations (FFO) — a common industry standard for reporting REIT operations. It’s the net income available to common shareholders as defined by NAREIT.

- Revenue per Available Room (RevPAR) — evaluates a hotel’s ability to fill available rooms at an average rate. A high RevPAR means a higher occupancy rate or a higher daily average room rate.

- Occupancy Rate — the ratio of rented rooms to the total rooms owned

With all of those parameters defined, the table below gives you a picture of how well the company has managed its operations from 2017 up to the present.

| Fiscal Year | Total Equity | Total Revenue | Net Income (Loss) | FFO | RevPAR | Occupancy |

| June 2021 (YTD) | $3.09B | $406M | ($26M) | $65.9M | $85.28 | 70.7% |

| FY 2020 | $3.03B | $601.8M | ($173M) | $13.4M | $51.34 | 46.1% |

| FY 2019 | $3.29B | $1.26B | $171.9M | $361.1M | $105.72 | 77.0% |

| FY 2018 | $3.4B | $1.27B | $206M | $391.6M | $104.66 | 76.9% |

| FY 2017 | $3.57B | $1.04B | $182M | $387.7M | $104.13 | 77.4% |

Source: Apple Hospitality REIT’s 10-K SEC filings

In FY 2020, total revenue dropped to almost 50%, net loss was incurred, and FFO, RevPAR, and Occupancy hit an all-time low for the past 4 years. The Company’s board members’ financial response to the pandemic was to voluntarily forego their executive compensation. The Company’s CEO agreed to waive 6 months of his salary while the Board of Directors volunteered to reduce their annual fees by more than 15%.

In 2021, the Company’s financial numbers are slowly recovering. As of the 2nd quarter of 2021, net loss was still incurred but it has gone down relatively to $26M. Also, hotel operations seem to come back stronger with a 70.7% occupancy rate. While everything is still unpredictable on how the pandemic will continue to play out, the Company is expecting the decline to continue in further years.

Dividend History

Before the pandemic, the Company distributed dividends monthly for $1.20 per common share. The last monthly distribution was made on March 16, 2020.

Source: Seeking Alpha

Since March 2020, the Company has suspended its monthly distributions. It only came back on the first quarter of 2021 where the quarterly distributions of $0.01 per common share started.

Peer Comparison

The whole hotel industry was heavily affected by the COVID-19 pandemic. Understandably, negative financials were uncommon. But compared to its peers, how did Apple Hospitality REIT perform?

Source: Investor Presentation (August 2021)

For the second quarter of 2021, FFO metrics were compared within the upscale to upper-upscale hotel companies. APLE outperformed among the 10 companies compared with. Its similar competitors were Summit Hotel Properties, Inc. (INN) and Catham Lodging Trust (CLDT) which were also both operating in upscale, room-focused hotels.

How about compared to market indices?

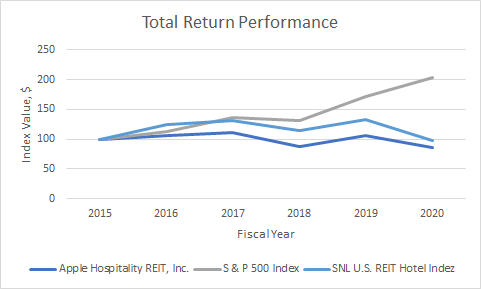

To create a fair comparison, a basic assumption was made with an initial investment of $100. Then, the total returns (distributions and capital gains) were compared among APLE, S&P 500 Index, and SNL U.S. REIT Hotel Index.

Data Source: Apple Hospitality REIT’s 10-K Report (2020)

The S&P 500 Index is a much more broad benchmark that includes large-cap companies from different industries beyond lodging. Hence, essential industries influenced the share returns. A much more appropriate benchmark would be the SNL U.S. REIT Hotel Index which consists of publicly traded REITS in the hotel industry. The REIT Index has slightly outperformed APLE.

Forecasts From Analysts

Future projections within the hotel industry are uncertain because everyone is still proactively fighting against the pandemic. When new COVID-19 variants will continue to persist, they will continue to heavily affect the hotels. But with the rollout of vaccines around the world, the hope is to get back to how things were before 2020.

Source: Seeking Alpha

However, some sites like Seeking Alpha provide forecasts. You can visit their site to learn more about future projections. But always take note that these should be taken with a grain of salt.