Unlike data storage and the world’s aging population, the amount of land available in the world is not increasing, except for maybe a few additional blocks in lower Manhattan. Like the climate, the real estate investment landscape has undergone some terrifying changes in the past several years, with the advent of tech firms from Amazon to WeWork, as well as the passage of Tax Cuts and Jobs Act (TCJA). While REITs continues to present an attractive investment vehicle, the traditional real estate investment model is a thing of the past.

In this article, we provide a few REITs that focus on fast-growing real estate reliant areas of the economy.

1) EQUINIX (EQIX)

A downside to traditional REITs is, thanks to tech firms ranging from Amazon and Airbnb through Uber and WeWork, many tried-and-true real estate models have been turned on their heads. Throw in politics, business cycles and new tax laws, and once rock-solid real estate investments that are the bread and butter of most REITs suddenly seem risky. Enter tech-oriented REITs such as Equinix, Inc. (EQIX).

Equinix owns real estate and rents it out to internet companies; not for office space, but to house the servers where the datacenters that host the Internet live. No, the Internet does not reside in the clouds, but on terra firma – and maybe eventually on the ocean floor. SOURCE: Microsoft.

About Equinix

Equinix, Inc. is an American company founded in 1998 and headquartered in Redwood City, California. Operating global colocation data centers, the hot REIT specializes in internet connection, cloud facilities and related services, and helps businesses with IT and cloud strategies.

Industry Focus & Size

| Industry | Employees | Market Cap | PE Ratio |

|---|---|---|---|

| Data Centers | 7,273 | $33.8 billion | 92.41 |

By 2002, Equinix had operated centers in the Asia-Pacific. In 2007 it expanded into Europe, and then Latin America in 2011 and the Middle East in 2012. Now, the firm boasts over 200 data centers in 52 metropolitan areas in 22 countries on 5 continents. It has 85 data centers in North America and South America, sited in Brazil, Canada and the United States. The largest colocation provider in Europe, Equinix is the eighth-largest Internet exchange point by size in the world.

On February 7, 2019, Equinix announced that Google chose it to support the search giant ’s new high-capacity, 10,000 km long, subsea cable connection called the Curie subsea cable system. The fiber optic runs from Los Angeles, CA to Valparaiso, Chile.

Historical Performance

| 2018 INCOME & REVENUE SUMMARY | ||

|---|---|---|

| Revenues | $5.0 billion | +16% YoY |

| AFFO | $1.7 billion | +15% YoY (includes $31M integration costs) |

Future Outlook

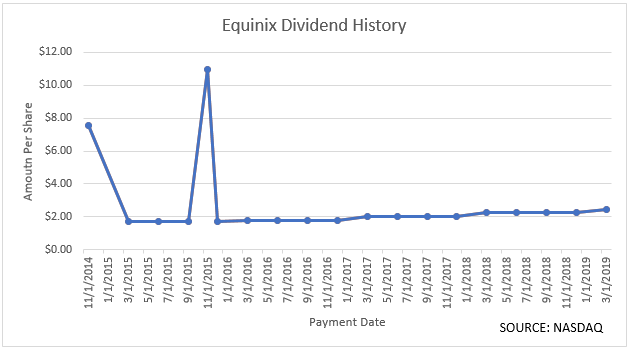

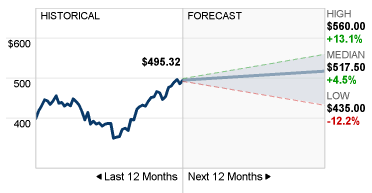

The performance outlook for Equinix is extremely positive, with an expected share price growth over the next year of over 7% on the low end to over 30% on the high.

These growth expectations are more in line with a tech company than a REIT, which makes sense. After all, Equinix’s growth is tied to the demand for data storage, which is growing at a breakneck pace. The world’s thirst for it, driven by the worldwide growth of smartphones, laptops, and tablets, the Internet of Things (IoT) and the rollout of 5G. The market will only accelerate over the next several years.. Ironically, unlike traditional brick and mortar real estate that uses physical space, data storage is not going virtual any time soon. Until that happens, the demand for data storage centers, such as those owned by Equinix, will only grow.

These growth expectations are more in line with a tech company than a REIT, which makes sense. After all, Equinix’s growth is tied to the demand for data storage, which is growing at a breakneck pace. The world’s thirst for it, driven by the worldwide growth of smartphones, laptops, and tablets, the Internet of Things (IoT) and the rollout of 5G. The market will only accelerate over the next several years.. Ironically, unlike traditional brick and mortar real estate that uses physical space, data storage is not going virtual any time soon. Until that happens, the demand for data storage centers, such as those owned by Equinix, will only grow.

2) DIGITAL REALTY TRUST (DLR)

Digital Realty Trust, Inc., incorporated on March 9, 2004, is a real estate investment trust (REIT) headquartered in San Francisco, CA. Engaged in the business of owning, acquiring, developing and operating data centers, Digital Realty is provides data center and colocation solutions for domestic and international tenants across a range of industries, ranging from financial services, cloud and information technology services, to manufacturing, energy, healthcare and consumer products. SOURCE: Digital Realty

Industry Focus & Size

| Industry | Employees | Market Cap | PE Ratio |

|---|---|---|---|

| Data Centers | 1,530 | $26 billion | 18.01 |

Digital Realty serves over 2,300 firms in its data centers located in 13 countries and more than 35 metro areas, including Atlanta, Boston, Chicago, Dallas, Los Angeles, New York, Northern Virginia, Phoenix, San Francisco, Seattle and Silicon Valley, Amsterdam, Dublin, Frankfurt, London, Paris, Singapore, Sydney, Melbourne, Hong Kong and Osaka. The firm operates on the five continents of North America, Europe, Latin America, Asia and Australia.

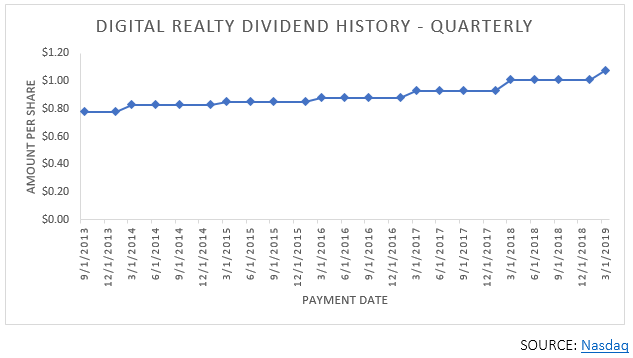

Historical Performance

| 2018 INCOME & REVENUE SUMMARY | ||

|---|---|---|

| Revenues | $3.08 billion | +22.6% YoY |

| AFFO | $1.3 billion | +37% YoY |

Future Outlook

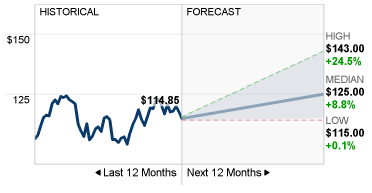

The outlook for Digital Realty is uniformly positive, with a buy consensus among analysts. The median target share price is $125, an increase of 4.7% over the current price, a high of $140 (+17.3%) and an estimated low of $114 (-4.5%).

Source: CNN Money

Source: CNN Money

These growth expectations reflect not only the health of Digital Realty Inc., but also the growth potential of the digital real estate sector, whose growth is tied to the demand for data storage, which is growing at a breakneck pace. As demonstrated by the firm’s recent joint venture with Mitsubishi to purchase a 5 acre parcel of land in a strategic location in Tokyo upon which to develop a data center (SOURCE: Yahoo!Finance), the world’s thirst for data centers, driven by the worldwide growth of smartphones, laptops, and tablets, the Internet of Things (IoT) and the rollout of 5G.

The market will only accelerate over the next several years (SOURCE: MarketsandMarkets). Ironically, unlike traditional brick and mortar real estate uses physical data storage is not going virtual any time soon. Until that happens, the demand for data storage centers on the planet earth, such as those owned by Digital Realty, will only grow.

3) AMERICAN TOWER (REIT) (AMT)

With headquarters in Boston, MA, American Tower (AMT) owns and operates wireless and broadband communications structures around the world in urban and rural locations. With offices across the United States and in Argentina, Brazil, Chile, Colombia, Costa Rica, France, Germany, Ghana, India, Kenya, Mexico, Nigeria, Paraguay, Peru, South Africa and Uganda, and investments worldwide. AMT is one of the largest global REITs. The sprawling company’s portfolio consists of over 170,000 communications sites worldwide, with more than 40,000 broadcast towers and approximately 15,000 managed rooftops and services that speed network deployment.

Founded in 1995, American Tower began as a subsidiary of American Radio. In 1998 AMT was spun off from American Radio and went public on the New York Stock Exchange as AMT. In 2011, American Tower publicly declared its intentions to become a REIT, and officially did so in 2012. Notably in 2015, AMT acquired the exclusive right to 11,448 of Verizon’s Communications, Inc.’s wireless communications sites. Fortune magazine named American Tower a Fortune 500 company for the first time in 2017. In 2018, the company entered Kenya and India through acquisitions of towers and transactions with local communications infrastructure firms. SOURCE: AMT & Nareit

Industry Focus & Size

| Industry | Employees | Market Cap | PE Ratio |

|---|---|---|---|

| Wireless/Broadband Infrastructure | 4,752 | $80.1 billion | 26.19 |

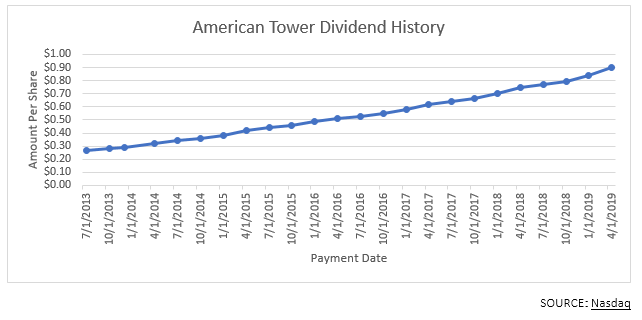

Historical Performance

| 2018 INCOME & REVENUE SUMMARY | ||

|---|---|---|

| Revenues | $7.44 billion | +11.6% YoY |

| AFFO | $3.54 billion | +22% YoY |

SOURCE: American Tower

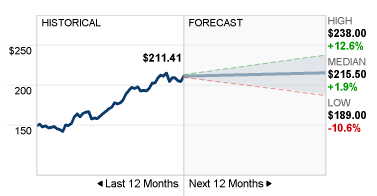

Future Outlook

The performance outlook for American Tower is cautiously positive, with an expected share price growth over the next year of over 7% on the low end to over 30% on the high. The 15 analysts offering 12-month price forecasts for AMT have a median target of $185, with a high estimate of $210 and a low of $147. The median represents a -5.2% decrease from the recent price of $195.05.

SOURCE: CNN Money

SOURCE: CNN Money

While AMTQ4 2018 revenues outperformed many analysts’ expectations (SOURCE: Zacks), outlook for the company is mixed. There is a greater than 30 point spread between the high and low Twelve-month price forecasts, with a median target of 185.00, a high estimate of 210.00 and a low estimate of 147.00. The median estimate represents a -5.15% decrease from the last price of 195.05.

With the ever-increasing demand for mobile broadband, specifically the expectations surrounding demand for 5G, and American Tower’s recently reported rollout of smart poles to support 5G, point towards the possibility the AMT may once again beat expectations in the coming year.

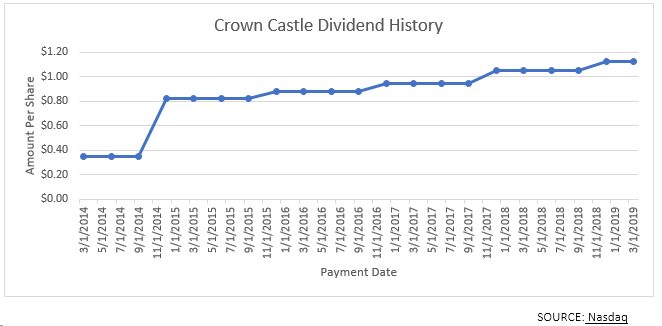

4) CROWN CASTLE INTERNATIONAL (CCI)

Crown Castle International Corp. is a REIT founded in 1994 by Ted B. Miller Jr. and Edward C. Hutcheson Jr. and headquartered in Houston TX. As America’s largest provider of shared communications infrastructure, it boasts more than 40,000 cell towers, 65,000 on-air or under-contract small cell nodes, and approximately 65,000 route miles of fiber in every major U.S. market. SOURCE: Crown Castle

Crown Castle designs, builds and provides access to telecommunications connectivity infrastructure. The solutions it offers range from “wireless coverage to smart city solutions to custom fiber optic networks.” SOURCE: Crown Castle International.

More specifically, CCI provides access to wireless infrastructure via long-term contacts on cell towers throughout the United States and via fiber optics infrastructure supporting mostly small cell networks. SOURCE: MarketWatch Interestingly, CCI also works to support future tech such as 5G and telemedicine. SOURCE: Crown Castle International.

Industry Focus & Size

| Industry | Employees | Market Cap | PE Ratio |

|---|---|---|---|

| Communications Infrastructure | 5,000 | $49.7 billion | 26.19 |

Historical Performance

| 2018 INCOME & REVENUE SUMMARY | ||

|---|---|---|

| Revenues | $5.42 billion | +24.5% YoY |

| AFFO | $2.27 billion | +22% YoY |

SOURCE: Crown Castle

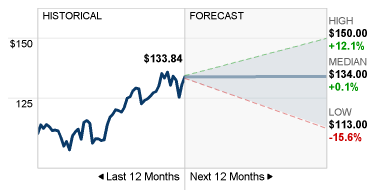

Future Outlook

The performance outlook for Crown Castle is positive, with an expected share price decrease over the next year of approximately 4%. However, the 15 analysts offering 12-month price forecasts for CCI have a median target of $121, with a high estimate of $136 and a low of $105. The median represents a -4.1% decrease from the recent price of $126.19.

SOURCE: CNN Money

SOURCE: CNN Money

Notably, despite relatively conservative expectations, Crown Castle appears to have plenty of untapped growth in its future. In Q4 2018 its earnings more than doubled. Similarly, considering that mobile traffic is expected to double within the next 3 years, Crown Castle is positioned to experience strong growth. SOURCE: The Motley Fool.

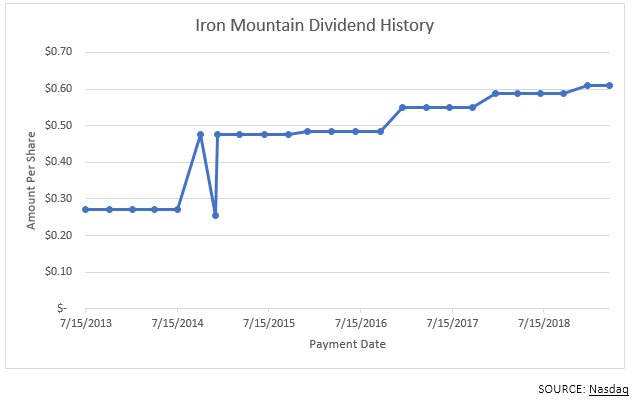

5) IRON MOUNTAIN (IRM)

Iron Mountain Incorporated, founded in 1951 by Herman K. Knaust, is headquartered in Boston, MA. It is the global leader for storage, destruction, data and information management services. In addition to traditional paper document storage, the company provides digital storage solutions in the form of data centers and cloud services as well as compliance and information recovery services. Iron Mountain operates divisions throughout the US, Canada, Europe, Australia, Asia and Australia.

Operating more than 1,400 storage facilities in over 50 countries, Iron Mountain serves over 225,000 customers. Its real estate network consists of over 85 million square feet of store structures.

Industry Focus & Size

| Industry | Employees | Market Cap | Net Income |

|---|---|---|---|

| Storage/Data | 25,000 | $10 billion | $363 million |

Historical Performance

| 2018 INCOME & REVENUE SUMMARY | ||

|---|---|---|

| Revenues | $4.23 billion | +9.9% YoY |

| AFFO | $874 million | +16.2% YoY |

SOURCE: Craft

Future Outlook

Iron Mountain is an example of an analog company that has not only made a successful transition into the digital age, but straddles both the past and the future. As a result, it uniquely houses both physical documents and virtual ones. As the world’s storage need for both forms of information continue to grow, Iron Mountain as a leader is well positioned as a solid investment.

SOURCE: CNN Money

SOURCE: CNN Money

As reported on March 20th, Iron Mountain is further diversifying its storage and logistical businesses with its $30M financing of the on-demand, high-tech, consumer storage company, Makespace. Makespace will become a strategic partner and tenant of Iron Mountain. SOURCE: AP News.

Twelve-month price forecasts for Iron Mountain vary greatly. Its median target is $37.50, the high is $52 and the low is $25.00. The median estimate of $37.50 reflects a 5.3% increase over its recent price of 35.60. While Iron Mountain might not offer the steep appreciation of some pure tech-oriented REITs, it seems well positioned for steady growth ahead. As such, analysts consistent recommend it as a hold.

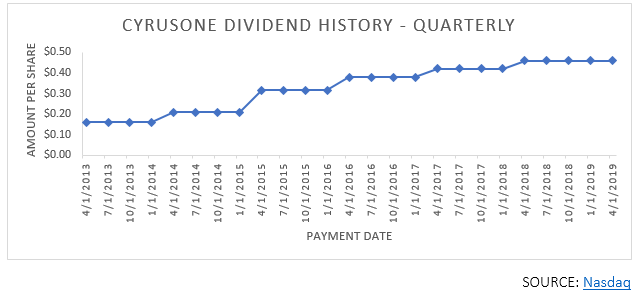

6) CYPRUSONE (CONE)

CyrusOne, headquartered in Dallas, TX, specializes in highly reliable enterprise data center colocation, engineering facilities with the highest power redundancy (2N architecture) and power-density infrastructure required to deliver excellent availability. It provides mission-critical data center facilities that protect and ensure the continued operation of information technology (“IT”) infrastructure for approximately 1000 customers, including 200 of the Fortune 1000 companies and nearly half of the Fortune 20 or private or foreign enterprises of equivalent size. The company designs, builds, and operates 45 facilities across the United States, Europe, and Asia.

CyrusOne’s portfolio includes 45 enterprise-class facilities in 11 states and across three continents. It controls more than 4 million square feet of total net rentable square footage.

Industry Focus & Size

| Industry | Employees | Market Cap | P/E Ratio |

|---|---|---|---|

| Data center | 448 | $5.7 billion | 15.73 |

Historical Performance

The company that is now CyrusOne was formed in 2001. In 2007 it was acquired by the private equity firm ABRY Partners, and then again by Cincinnati Bell three years later. On January 18, 2013, CyrusOne began trading on the Nasdaq under the symbol CONE. Since then the company has been expanding rapidly across the U.S. and into Europe and Asia.

| 2018 INCOME & REVENUE SUMMARY | ||

|---|---|---|

| Revenues | $824 million | +22.6% YoY |

| AFFO | $332 million | +19% YoY |

SOURCE: CyprusOne

Future Outlook

The outlook for CyrusOne is extremely positive, with an expected share price growth over the next year ranging between 14% and 33%, with an extreme minority of analysts recommending sell. The 17 analysts offering 12-month price forecasts for CyrusOne Inc are in consensus with a buy rating. They set a median target of $60, with a high estimate of $70 and a low estimate of $49. The median estimate represents a 14.42% increase from the recent price of $52.44.

SOURCE: CNN Money

SOURCE: CNN Money

These growth expectations are more in line with a tech company than a REIT, which makes sense. After all, CyrusOne’s growth is tied to the demand for data storage, which is growing at a breakneck pace. The world’s thirst for it, driven in particular by the growing demand for outsourced cloud data storage. The market will only accelerate over the next several years. CyrusOne’s recent hire of former Akamai Technologies and Microsoft Executive John McCloskey to serve as the new Vice President of Hyperscale and Cloud Sales for CyrusOne highlights the firm’s focus on this space.

SOURCE: MarketsandMarkets. Ironically, unlike traditional brick and mortar real estate uses, physical data storage is not going virtual any time soon. Until that happens, the demand for data storage centers on the planet earth, such as those owned by CyrusOne, along with the premium services it provides will only grow.

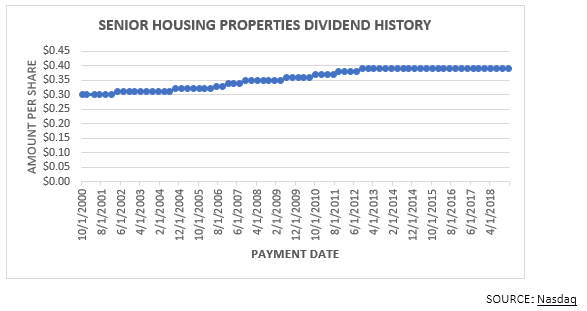

7) SENIOR HOUSING PROPERTIES TRUST (REIT) (SNH)

With headquarters in Newton, MA, Senior Housing Properties Trust (SNH) is a “healthcare REIT which owns senior living communities, wellness centers, spas, office buildings leased to medical providers, medical related businesses, clinics, and biotech laboratory tenants throughout the United States.

The company offers short-term and long-term healthcare, services for its senior living residents in a variety of ownership and management arrangements with its occupants and tenants. It is managed by the RMR Group LLC and was founded on December 16, 1998 and is headquartered in Newton, MA.

Industry Focus & Size

| Industry | Employees | Market Cap | P/E Ratio |

|---|---|---|---|

| Healthcare | 600 | $2.37 billion | 10.09 |

Historical Performance

| 2018 INCOME & REVENUE SUMMARY | ||

|---|---|---|

| Revenues | $1.11 billion | +3.9% YoY |

| AFFO | $377.3 million | Flat YoY |

SOURCE: BusinessWire

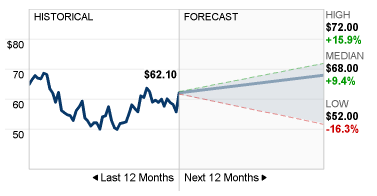

Future Outlook

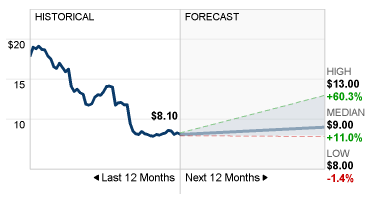

The performance outlook for Senior Housing Properties is cautiously positive, with a median expected share price growth over the next year ranging greatly from -28% to over +68% with a median outlook of +2.2%. The 5 analysts offering 12-month price forecasts for SNH have a median target of $10, with a high estimate of $16.50 and a low of $7. The median represents a -2.2% increase from the recent price of $9.78.

SOURCE: CNN Money

SOURCE: CNN Money

This outlook is despite the company’s recent reported slashing of its dividend rate due to its restructuring of its business arrangement with its largest tenants, Five Star Senior Living . Despite its recent stock price dip and loss of love by analysts, SNH represents a good value in a marketplace with high demand for the foreseeable future. Serving the huge Baby Boomer population, the healthcare REIT space is well-positioned to flourish as the Boomers retire and seek the housing and services SNP supports.

Additionally, due to the effects of the Tax Cuts and Jobs Act (TCJA), passed in December 2017, home ownership for this population will continue to be a less attractive option, and thus likely increase migration of Boomers flush with cash after selling their homes into facilities such as those owned and managed by SNH.

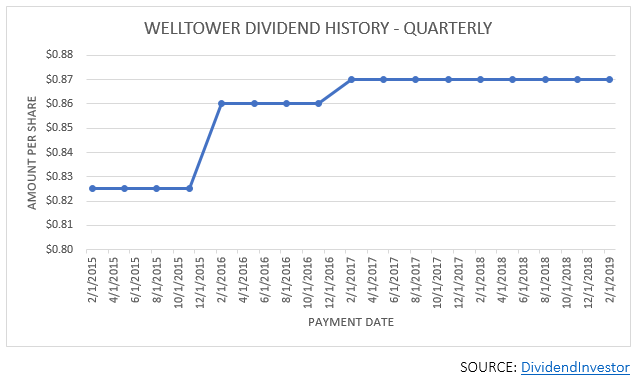

8) WELLTOWER (WELL)

Welltower Inc. (NYSE: WELL), an S&P 500 company headquartered in Toledo, Ohio, owns and provides capital for a collection of senior-housing properties, outpatient medical facilities, health systems, and long-term/post-acute care facilities. The REIT invests with seniors housing operators, post-acute providers and health systems to fund the real estate infrastructure for their facilities. Their properties are concentrated in major, high-growth markets in the United States, Canada and the United Kingdom.

Industry Focus & Size

| Industry | Employees | Market Cap | P/E Ratio |

|---|---|---|---|

| Senior Housing | 392 | $20.9 billion | 19.45 |

Historical Performance

The company was established in 1970 in Lima, Ohio under the name Health Care Fun. In 1985 the firm incorporated as Health Care REIT and moved its headquarters to Toledo, Ohio. By 1996 when George Chapman was named CEO, Health Care REIT had $62 million in total assets. In 2015, with assets exceeding $25 billion in the U.S., Canada and the UK, the firm names Thomas J. DeRosa as CEO and changes its name to Welltower. In 2018, with assets exceeding $30 billion, Welltower changes its ticker symbol to “WELL” and closes a deal to acquire Quality Care Properties and HCR ManorCare for $4.4 Billion.

| 2018 INCOME & REVENUE SUMMARY | ||

|---|---|---|

| Revenues | $4.64 billion | +9% YoY |

| FFO | $1.01/share | -1.4% YoY |

SOURCE: Zacks

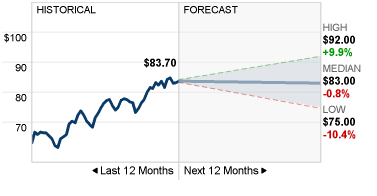

Future Outlook

The majority on analysts polled on a major business site draws a consensus recommendation to hold Welltower’s stock. About 1/3 of analysts recommend a buy and only 1 says sell.

SOURCE: CNN Money

SOURCE: CNN Money

Having been called a recession proof SWAN REIT, Welltower presents an attractive long-term value for several reasons. Due to its positioning near ageing dense population centers, where there not only exists a large population of ageing adults, but also pricey real estate markets where housing is expensive for seniors to own, and highly profitable for them to sell and then move to a Welltower facility.