Key Takeaways

- Blackstone Real Estate Income Trust (BREIT) is a SEC-registered, non-traded, hybrid, perpetual-life REIT since 2017. It invests in real estate properties across 8 sectors and real estate debt through mortgage-backed securities and other real estate-related loans.

- As of July 2021, BREIT has a total of 1,508 real estate properties in the residential, industrial, net lease, self-storage, hotel/hospitality, retail, and office sectors located across the U.S.

- BREIT’s occupancy rates are all above 90% for almost all sectors, with the exemption of the hotels/hospitality sector which was heavily affected by the COVID-19 pandemic.

- As of their Q2 2021 report, total real estate debt investments have a fair value of $5.7B with a weighted average coupon of 5% and a weighted average maturity date of July 5, 2025.

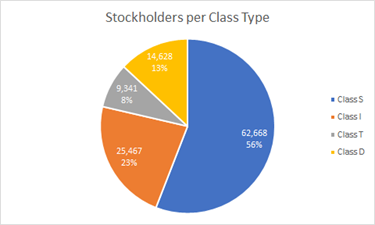

- BREIT has 4 types of common shares which differ in how the investors will be charged. Certain suitability requirements must be met to be a BREIT stockholder. As of March 17, 2021, it has a total of 112,104 stockholders.

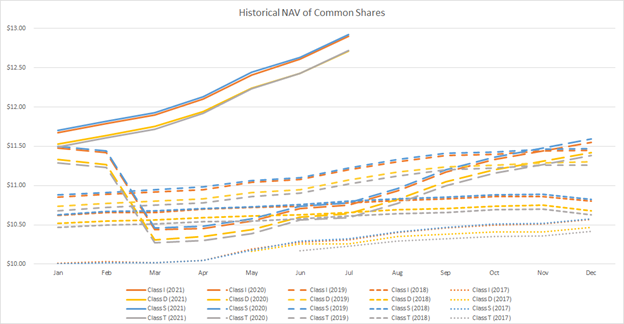

- BREIT’s common stocks are priced at their fair value in terms of NAV — net asset value. Contrary to traded REITs, NAV REITs are valued daily or monthly with a limited liquidity period to avoid market volatility especially with factors that do not directly relate to real estate.

- The general trend of NAV prices for all class shares was increasing — until a sudden drop occurred in the first quarter of 2020 during the onset of the COVID-19 pandemic. However, it recovered by the end of 2020 and soared in the first half of 2021.

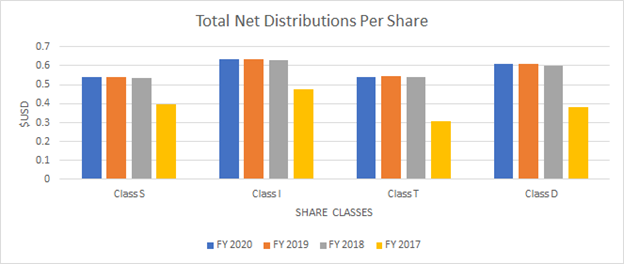

- BREIT issues consistent monthly distributions since its inception. As of FY 2020, each common stock class received a gross distribution of $0.6354 per share.

- For FY 2020, Class I shares were still the highest ($0.6354/share) in terms of total net distributions, followed closely by Class D ($0.608/share).

- Since inception date to July 31, 2021, total returns (without initial sales charge fees) were between 10% – 11% across all types of share classes.

- BREIT outperformed the MSCI U.S. REIT Index net return in 2020 (-7.6%) with a 6.1% net return of Class S shares which has the most number of stockholders among its common shares.

Company Background

Blackstone Real Estate Income Trust, Inc. (BREIT) has real estate investments in diverse sectors such as residential, industrial, office, storage, and hotel/hospitality. They are also open to venturing into healthcare and data center sectors. All of these are made possible through sponsorship from the Real Estate Group of The Blackstone Group, Inc. with decades of real estate experience.

BREIT also has real estate debt investments through securities and loans backed by the U.S. market. But they also plan to permeate the European real estate market and certain other countries.

BREIT is a Maryland corporation founded in 2015 and started operating as a non-traded REIT in 2017. With the help of BX REIT Advisors LLC, their investment strategy is to invest in stabilized and diverse real estate portfolios to provide income to their investors. Their corporate headquarters is located at 345 Park Avenue, New York.

Blackstone REIT Type

Public, Non-Traded, Perpetual-Life REIT

BREIT is a SEC-registered REIT since 2017. The company reports its financial statements and regular updates through SEC filings for public reference. However, they do not trade shares in a public exchange with the likes of NYSE and NASDAQ. If investors want to buy BREIT shares, they must have:

- A minimum investment of $2,500 for Classes T, S, and D common stocks

- A minimum investment of $1M for Class I common stock (unless waived by the dealer manager)

- Either a net worth of at least $250,000, or a gross annual income of at least $70,000 with a net worth of at least $70,000

- Certain suitability standards for select states

BREIT has 4 types of share classes which differ in how the investors will be charged. A disadvantage of non-traded REITs is the higher management fees as compared to traded REITs.

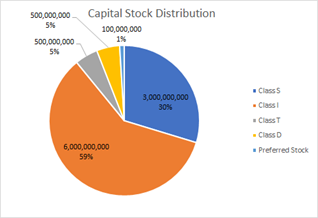

Source: BREIT Fact Card

Source: BREIT Fact Card

As of August 1, 2021, there are:

- 1,573,576,957 Class I shares

- 217,635,951 Class D shares

- 1,024,512,149 Class S shares

- 53,024,993 Class T shares.

Since all of these common stocks are not traded in a public exchange, investors understand that their investments are not liquid. To liquidate their assets, BREIT must repurchase their shares, which is not guaranteed. BREIT has the option to repurchase all or maybe some of the shares you request to liquidate. At times, they might not even repurchase at all when you need the money urgently. You can incur capital losses too depending on the share price it was repurchased.

BREIT’s common stocks are priced at their fair value in terms of NAV — net asset value. Contrary to traded REITs, BREIT invests in perpetual-life REITs wherein NAV prices are valued daily or monthly with a limited liquidity period. This is to avoid market volatility especially with factors that do not directly relate to real estate. NAV REITs do away with daily price fluctuations, making them less volatile compared to traded REITs. Currently, BREIT’s presence dominates in the NAV REIT market.

Hybrid REIT

The 2 main distinctions of REITs in terms of how they earn income are equity and mortgage REITs. BREIT is a hybrid REIT because it deals with both.

As an equity REIT, they have a diverse coverage of real estate investments. The majority of their real estate properties are in the residential (especially multifamily homes) and industrial sectors. They earn income by leasing out rental spaces to clients.

As a mortgage REIT, they have real estate debt investments through commercial and residential mortgage-backed securities. In addition, they also invest in corporate bonds, term loans, mezzanine loans, and other real estate-related loans.

Ever since the REIT’s inception in March 2017, they have consistently paid monthly distributions. Usually, these distributions are credited 20 days after the end of every month. As of FY 2020, each common stock class received a gross distribution of $0.6354 per share.

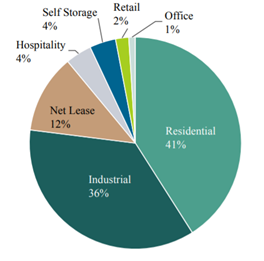

Diverse Mix of Sectors

Source: BREIT Prospectus (as of June 30, 2021)

Source: BREIT Prospectus (as of June 30, 2021)

BREIT has a diverse real estate property portfolio. Their recent investments are, namely, in residential, industrial, net lease, hospitality (leisure market), self-storage, retail, and office. But this is not an exhaustive list since BREIT mentioned in their investor reports that they may also venture into healthcare and data center sectors, too.

What Blackstone REIT Fund Invests In

As of July 2021, BREIT has a total of 1,508 real estate properties located across the U.S. and a small percent in Europe.

Source: BREIT Q2 2021 Report

Source: BREIT Q2 2021 Report

This covers BREIT’s direct property investments, equity in public and private real estate-related companies, and unconsolidated investments. The unconsolidated investments come from their joint venture with MGM Growth Properties LLC, wherein BREIT owns 49.9% of interest.

Their current real estate investments operate in 7 sectors:

- Residential — includes rental housing such as multifamily and single-family homes, student housing, senior living, and manufactured housing. As of June 30, 2021, this makes up 41% of their real estate investments. Residential leases are mostly fixed-base rent for the short term (not exceeding 12 months). In cases of pass-through operating expenses such as utilities, leases can have a variable component.

- Industrial — includes warehouse spaces for the commerce industry. Leases are generally fixed-base rent, but they also have variable components for cases of reimbursement of operating expenses (e.g. property taxes, insurance, common area maintenance costs). Lease contracts are long-term with extension and termination options.

- Net Lease — refers to assets of The Bellagio Las Vegas and unconsolidated interest income from MGM Grand and Mandalay Bay Lease contracts are long-term with extension and termination options.

- Hotel or Hospitality — also refers to leisure properties in which revenues are particularly dependent on the daily operations of property managers. Other than its seasonal profitability, the leisure market was, as expected, heavily affected by the pandemic.

- Self-Storage — includes storage spaces for personal and business consumption. Leases are fixed-base rent only.

- Retail — includes malls and shopping centers. Leases are generally fixed-base rent, but they also have variable components for cases of reimbursement of operating expenses (e.g. property taxes, insurance, common area maintenance costs). Lease contracts are long-term with extension and termination options.

- Office — Leases are generally fixed-base rent, but they also have variable components for cases of reimbursement of operating expenses (e.g. property taxes, insurance, common area maintenance costs). Lease contracts are long-term with extension and termination options.

BREIT’s acquired assets are growing continuously. Despite the pandemic, they acquired worth $10.5B of real estate properties in the multifamily, industrial, and net lease sectors in 2020. As of June 30, 2021, their total properties were 1,463. Just a month after, it grew to 1,508 properties.

Real Estate Debt

BREIT also invests in non-distressed public and private real estate debt such as:

- Commercial mortgage-backed securities (CMBS)

- Residential mortgage-backed securities (RMBS)

- Real estate-related corporate credit

- Mezzanine loans and mortgage loans

- Equity interests from public and private companies that invest in real estate debt

- Collateralized debt and loan obligation vehicles

With the expertise of their investment advisors, BREIT uses leverage through financing to multiply their funds for the increased potential of investment returns. BREIT outsources third-party pricing service providers to determine the fair value for these debt investments.

BREIT Portfolio

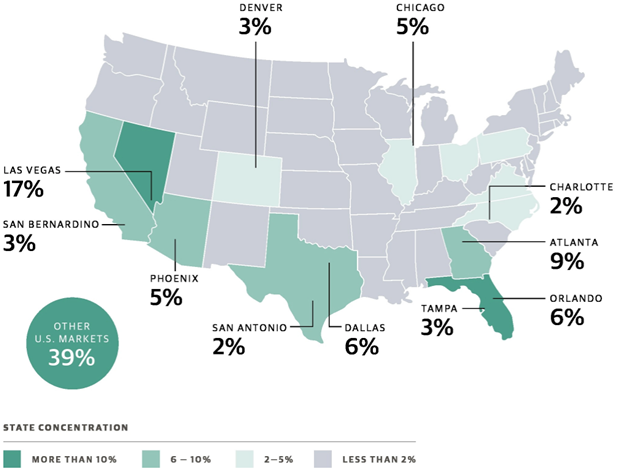

Market Geography

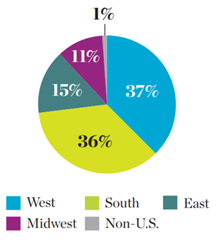

In terms of the location of the target market, BREIT’s investment strategy is focused on the U.S. market. Their strongest market comes from the West and Southern states. However, they also have non-U.S. investments, particularly in Europe, to a small extent (by about 1%).

Source: BREIT Fact Card (as of July 2021)

Source: BREIT Fact Card (as of July 2021)

Investment Portfolio Category

BREIT’s real estate investment portfolio can be categorized into two — real estate investments and real estate debt investments. According to their 2020 annual report, they hold 1,370 real estate properties and 228 positions in real estate debt investments.

Source: BREIT Fact Card (as of July 2021)

Source: BREIT Fact Card (as of July 2021)

A majority (by 89%) of BREIT’s income comes from rental revenues across a diverse set of asset classes — much of it comes from residential and industrial sectors. Aside from contributing to the overall returns, real estate debt investments also provide added liquidity especially for cash management in the Company’s share repurchase plans.

Real Estate Properties

BREIT’s occupancy rates are all above 90% for almost all sectors, with the exemption of the hotels/hospitality sector. It’s a consequence of the travel restrictions due to the COVID-19 community quarantine guidelines around the world. For a more comprehensive brief of BREIT’s real estate investment portfolio, refer to the table below.

| Sector | Units/Keys/Sq. Ft | Occupancy Rate | % of Total Revenue | Clients | No. of Properties |

| Residential | 93,174 units | 94% | 38% | EdR Student Housing Portfolio (10,610 units), Southeast MH portfolio (8,563 units), Acorn Multifamily Portfolio (8,309 units), etc. | 298 |

| Industrial | 154M sq. ft | 96% | 32% | Jupiter 12 Industrial Portfolio, Canyon Industrial Portfolio, Meridian Industrial Properties, etc. | 938 |

| Net Lease | 24.8M sq ft | N/A | 13% | Bellagio (NV), MGM Grand (NV), & Mandalay Bay (NV) | 3 |

| Hotel / Hospitality | 9,672 keys | 49% | 10% | Raven Select Service Portfolio, Hyatt Regency Atlanta (GA), JW Marriott San Antonio Hill Resort (TX), etc. | 58 |

| Self-Storage | 10.9M sq. ft | 94% | 4% | Simply Self Storage, East Coast Storage Portfolio, Cactus Storage Portfolio, etc. | 150 |

| Retail | 2M sq. ft | 96% | 2% | SoCal Grocery Portfolio, Canarsie Plaza (NY), Bakers Center (PA), etc. | 13 |

| Office | 946,000 sq. ft | 99% | 1% | EmeryTech Office (CA) & Coleman Highline Office | 3 |

| TOTAL REAL ESTATE PROPERTY INVESTMENTS (as of June 30, 2021) | 1,463 | ||||

Source: BREIT Q2 2021 Report

Residential, specifically multi-family homes, bring the most rental revenue to BREIT’s portfolio, followed by the industrial sector. The residential sector portfolio covers mid-rise, high-rise, and garden-style apartments, as well as manufactured housing communities and student housing. Their recent property acquisitions recorded as of June 2021 were 15 investments — 17 residential properties, 28 industrial properties, and 1 office property — amounting to $2.1B.

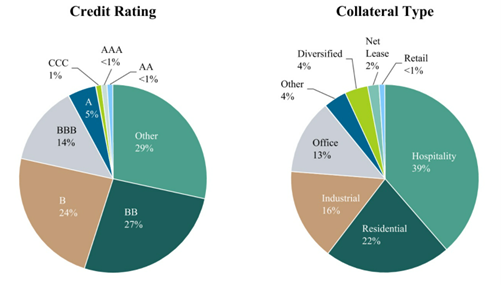

Real Estate Debt

As of FY 2020, BREIT’s real estate debt investments consist of 194 investments in CMBS, 15 investments in RMBS, 10 corporate bond investments, and 9 real estate loans. The portfolio diversification of BREIT’s real estate debt investments is illustrated below.

Source: BREIT Q2 2021 Report

Source: BREIT Q2 2021 Report

As of their Q2 2021 report, total real estate debt investments have a fair value of $5.7B with a weighted average coupon of 5% and a weighted average maturity date of July 5, 2025. Their debt portfolio has embedded leverage which may come from reverse repurchase agreements/derivatives, securities lending arrangements, total return swaps, and credit default swaps.

Investment Ownership

BREIT has the authority to issue a total of 10,100,000,000 shares. The distribution of these capital shares is specified below. Each type of share has a par value of $0.01.

Focusing on the common shares, BREIT has a total of 112,104 holders across the 4 types of class shares as of March 17, 2021. The stockholder distribution across the class shares is shown below.

Blackstone REIT Performance

Historical NAV Per Share

NAV REITs work differently from traditional publicly-traded REITs. Instead of daily price fluctuations, NAV REITs have a much less volatile movement. Investment advisors assess the shares and report them in terms of fair value, like how mutual funds work. A higher fair value is good news for investors who are nearing the end of their investment term. While a cheaper fair value is good news for new investors.

The figure above shows the historical NAV price of the 4 types of class shares. Class S shares were the first issued common stock of BREIT in 2017 at $10. This was followed by the Class I shares, Class D shares, and then the Class T shares. The general trend of NAV prices for all class shares was increasing — until a sudden drop occurred in the first quarter of 2020 during the onset of the COVID-19 pandemic. However, it recovered by the end of 2020.

For the first half of 2021, the NAV price soared high with Class S shares at the top values at $12.92/share (July 2021). This was followed close behind by Class I shares at $12.9/share.

Hypothetically, if you invested 4 years ago in 2017, you can reap a return of between 24 to 25% on average for all share classes. Total returns could be higher if you account for the accumulated share distributions throughout your investment years. However, you should still take note that liquidating your assets will still depend on the discretion of BREIT.

Key Performance Metrics Through The Years

The price history tells you how the company is valued at face value. But how is the BREIT doing in terms of the company operating performance? Certain parameters from financial statements will tell you how the company managed its investments through the ups and downs of the business cycle. Here are 4 of the critical parameters you should look at to measure the company’s operating performance:

- Total Equity — this represents the company’s net worth value. It tells us how big and valuable the company is in the market.

- Total Revenue —this parameter tells us how profitable the company is. How much does the company earn in doing its business?

- Net Income (Loss) — this parameter eliminates all the property operation expenses (e.g. maintenance, insurance, and taxes) from the total revenue. It tells us how much is the take-home pay of the company. Net losses occur either when expenses are greater than income, or when investment losses were greater than the revenue.

- Funds from Operations (FFO) — a common industry standard for reporting REIT operations. Funds from operations (FFO) is the net income excluding depreciation, amortization, impairment of investments, net gains or losses from the sale of real estate, and other unconsolidated entities.

| Fiscal Year | Total Equity | Total Revenue | Net Loss

(attributable to BREIT stockholders) |

FFO |

| June 2021 (YTD) | $23B | $1.5B | ($146M) | $483M |

| FY 2020 | $16.1B | $2.5B | ($853M) | $406M |

| FY 2019 | $10.6B | $1.7B | ($401M) | $358M |

| FY 2018 | $3.9B | $723M | ($281M) | $110M |

| FY 2017 | $1.5B | $158M | ($86.2M) | $33M |

BREIT’s total equity continues to increase as its investment portfolio expands across diverse sectors. The total revenue coming from rental income also seems to increase consistently. However, net losses have been incurred since 2017 which can be attributed to the real estate debt portfolio. But the better way to gauge a REIT’s performance is through its FFO. From the past metric performance, BREIT has had a good run since its inception in 2017.

Dividends Distribution History

Since its inception in 2017, BREIT has consistently issued monthly distributions to its stockholders. So far, its highest total net distribution (includes deductions of corresponding fees already) was Class I shares in FY 2019.

For FY 2020, Class I shares were still the highest ($0.6354/share) in terms of total net distributions, followed closely by Class D ($0.608/share). Both share classes can be bought through fee-based programs, registered investment advisors, institutional and fiduciary accounts.

Total Returns History

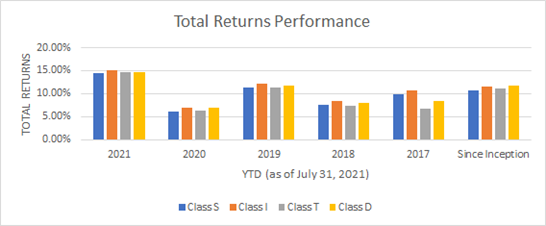

Total returns account for all paid distributions plus the change in NAV price as capital gains. The chart below shows the YTD performance of all class share classes, plus the since inception date returns.

Notes: Class D shares don’t include the upfront 1.5% sales charge at initial subscription yet.

Class S and T shares don’t include the upfront 3.5% sales charge at initial subscription yet.

2021 YTD returns were the highest because BREIT has recovered well from the effects of the COVID-19 pandemic. Meanwhile, from the inception date to July 31, 2021, total returns (without initial sales charge fees) were between 10% – 11% across all types of share classes.

Overall, BREIT is one of the leading players in the NAV REIT market industry. Despite the COVID-19 pandemic, BREIT achieved a 6.1% net return in 2020 for the Class S shares which has the most number of stockholders among its common shares. They have outperformed the MSCI U.S. REIT Index which generated only -7.6%.