Investing through REITs is a good way of getting into real estate without having to manage the properties yourself. If you’re looking for REITs to invest in, you may want to consider Hartman vREIT XXI, Inc.

Get to know more about what type of REIT it is, what the Company’s funds invest in, how they perform in the market, and their performance.

Key Takeaways

- Hartman, which refers to Hartman Income REIT Management, Inc. and its affiliates, has acquired more than 90 properties in the 23 investment programs since 1983.

- Hartman vREIT XXI, Inc. is one of its 2 public non-traded REITs. The other public REIT, Hartman Short Term Income Properties XX, has a similar investment strategy but it was closed to investors in March 2016.

- Hartman vREIT XXI fund invests in office, retail, light industrial, and flex spaces within the Texaplex area — Houston, Dallas, and San Antonio.

- Hartman vREIT XXI, Inc. is a public, non-traded, perpetual-life REIT since June 24, 2016. Investors can buy among its 4 types of common shares through brokerage and transaction-based accounts provided that they meet the suitability standards.

- With Hartman’s share redemption program, investors can have intermittent liquidity quarterly under certain conditions.

- According to their Q2-21 report, the REIT fund owns and manages 10 properties with a total leasable area of 881,215 square feet.

- If you invested early on during its IPO (at $10/share), there would only be a 2.3% increase in capital gain today (at $10.23/share).

- Net losses were consistent every year. These losses can be attributed to initial start-up costs, operating expenses before making investments, depreciation, and amortization expenses.

- Hartman vREIT XXI has consistently issued monthly distributions since January 2017. 38% of its total distributions from inception to March 31, 2021, came from cash flow from operating activities.

- Hartman remains steadfast with their Company’s vision — to grow the company to $2 billion in assets by 2025, and to $5 billion by 2030.

Company Background

Hartman Income REIT Management, Inc. and its affiliates, collectively referred to as “Hartman”, have been in the industry since 1983. With more than 35 years of experience, Hartman developed its core investment strategy of acquiring, redeveloping, repositioning, and re-tenanting properties in the office, retail, and industrial sectors. Their target market is specified within Texas, particularly Houston, Dallas, and San Antonio. Their office headquarters are located at 2909 Hillcroft, Suit 420, Houston, Texas.

Over time, Hartman has acquired more than 90 properties in the 23 investment programs that it has launched. Some of these are:

- 16 full-cycle private programs

- Hartman XIX — private, closed to investors, and currently operational

- Hartman Commercial Properties REIT — public and went full cycle in 2012

- Hartman Short Term Income Properties XX — public, non-traded REIT, closed to investors, and currently operational

- Hartman 3100 Weslayan — private, closed to investors, and currently operational

- 2 Delaware Statutory Trusts

- Hartman vREIT XXI, Inc. — public, non-traded REIT since 2016.

From here on, we will be focusing on the Hartman vREIT XXI REIT.

The REIT fund is sponsored by Hartman Income REIT Management, Inc. and advised by Hartman Advisors XXI, LLC.

- The Sponsor, founded on March 9, 2009, absorbs some of its properties into the REIT’s portfolio and also finances property acquisitions.

- Meanwhile, the Advisor, founded on September 10, 2015, is responsible for portfolio management — e.g. daily operations, marketing, investor relations, and administrative tasks. Although the advisory agreement is 1 year only, there can be unlimited yearly renewals as deemed by the Board of Directors.

REIT Type Summary

Hartman has 3 public REITs, but only 2 of them are currently operational. These are Hartman Short Term Income Properties XX (or Hartman XX)and Hartman vREIT XXI, Inc. Both REIT funds have similar investment strategies, so they may compete with investment opportunities. However, Hartman XX is already closed to investors with no remaining offering proceeds since March 2016.

Public and Non-Traded REIT

Hartman vREIT XXI has been registered with the SEC as a Maryland corporation since September 2015 and started operating as a non-traded REIT in 2017. The REIT fund is not publicly accessible in NYSE or NASDAQ exchanges. Rather, investors can buy shares through brokerage and transaction-based accounts provided that they meet the suitability standards:

- $250,000 net worth (excluding the value of home, furnishings, and automobiles)

- At least $70,000 gross annual income and a net worth of at least $70,000 (excluding the value of home, furnishings, and automobiles)

- Additional standards depending on which state the investor resides in

- Minimum opening investment account of $10,000 (non-qualified) or $5,000 (qualified)

Please note that suitability standards 1 and 2 are an either/or requirement. An investor is eligible as long as he qualifies for at least one of both standards.

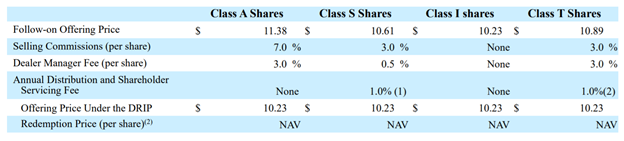

Hartman vREIT XXI started trading with an IPO of $269 million on June 24, 2016. It has public offerings for 4 types of class shares. They differ in administrative fees and commissions as shown in detail below.

Source: Q2-21 report

Source: Q2-21 report

As of August 1, 2021, there are:

- 8,461,093 Class A shares

- 474,848 Class T shares

- 10,336 Class S shares

- 7,813 Class I shares

Perpetual-Life REIT

A perpetual-life type of REIT has an indefinite holding period. The fair value of its common stocks is marketed through net asset value or NAV. This is determined quarterly for each share class as determined by the Board of Directors. When shares are offered in perpetuity, it means that the REIT can sell them continuously at a price that’s generally equal to the NAV per share price of the last quarter, plus upfront fees and commissions.

The downside of non-traded REITs is the illiquidity of funds. With Hartman’s share redemption program, investors can have intermittent liquidity quarterly under certain conditions.

- For example, Classes A, S, and T shares must be held for at least 3 years before they can sell their shares.

- Class I shares have a minimum holding period of 1 year.

- Despite this, it’s still by the discretion of the Board if they buy back the shares. In cases where Hartman accepts the shares back, it may or may not be for a discount at your expense.

As of January 14, 2020, Hartman vREIT XXI offers common shares worth $185,000,000, and about $4,000,000 in dividend reinvestment plans or DRIPs.

Equity REIT

Hartman’s total revenues come from rental income and tenant reimbursements. They own their properties and manage their daily operations through in-house property managers.

Diverse Sectors

Hartman vREIT XXI invests in more than one sector, particularly in commercial and light industrial properties. They redevelop underperforming properties with strong acquisition criteria. Their investment portfolio consists of offices, retail spaces, industrial, and flex spaces which are leased out at competitive rates while taking advantage of Texas’ booming economy.

What the REIT Fund Invests In

Hartman vREIT XXI fund invests in office, retail, light industrial, and flex spaces within the Texaplex area — Houston, Dallas, and San Antonio. Together, these cities comprise 77% of Texas’ economy, have 3x the job growth rate to that of New York’s, and 5x the growth rate to that of Los Angeles’.

Why Focus Investments in Texas?

From their SEC filings, Hartman has mentioned that they have no plans yet of acquiring properties outside of the United States. Currently, their investment properties are all located in Texas. Although, they are open to venture out to other states as long as the market is feasible.

- Texas has the 9th largest economy in the world.

According to 2019 data from the U.S. Bureau of Economic Analysis and The World Bank, Texas ranked 9th among the largest GDPs in the world, and 2nd in the United States.

- Texas ranked one of the Top 15 Best States in Tax Foundation’s 2021 State Business Tax Index.

Texas has one of the lowest tax burdens in the United States as recognized by the Tax Foundation’s 2021 State Business Tax Index. Texas’ lack of corporate income tax and individual income tax, along with its more than 14 million workers, makes it an ideal hotspot for businessmen and the civilian workforce.

- More than 90 Fortune 500 Companies’ Headquarters Are in Texas

Companies like the American Airlines Group and AT&T have their headquarters in Texas. Aside from the tax incentives, Texas also leads America’s export with approximately $279.3 billion in goods as of 2020 — a consistent feat for 19 years.

Although diversifying geographic locations is in Hartman’s future investment goals, it’s limited within the U.S. only and depends on future market trends. But thus far, Hartman’s specified target market is within the Texaplex area.

Acquisition Process and Criteria

The collective experience of the Hartman affiliates in the real estate industry is a huge advantage for expanding Hartman vREIT XXI’s investment portfolio. Its acquisition process and listed criteria are as follows:

Hartman vREIT XXI’s Program Brochure (as of July 2021)

Hartman vREIT XXI’s Program Brochure (as of July 2021)

Its acquired properties are focused on:

- Strategically located in high traffic areas in growing suburbans

- Adequate parking

- Strong curb appeal

- At least 50% occupancy rates

- For retail spaces — either a diversified tenant mix (e.g. restaurants, professional services, spas and salons, clothing, and other soft goods) or an exclusive credit-worthy tenant

- Retail tenants leasing between 40,000 to 200,000 square feet

- Light industrial tenants leasing at least 75,000 square feet. Only flex spaces containing offices, retail, and small warehouse spaces will be considered.

The Company prefers enhancing property values and generating increased rental income instead of relying on periodic lease rates along with a favorable economy.

REIT Portfolio

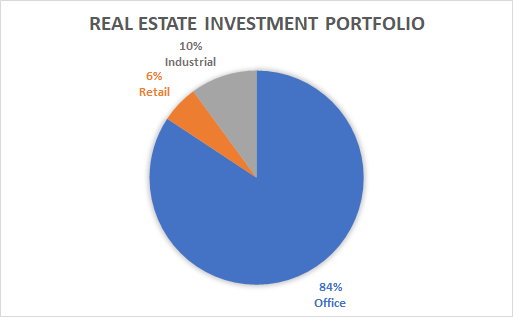

Source: Q2-21 report

Source: Q2-21 report

In terms of gross leasable area, Hartman vREIT XXI’s investment portfolio is comprised mostly in the office sector, followed by the industrial sector, then the retail sector. According to their Q2-21 report, the REIT fund owns and manages 10 properties with a total leasable area of 881,215 square feet. The full list of their properties as of June 2021 is shown below:

| Sector | Property | Gross Leasable Area (sq. ft) | Occupancy Rate | Ave. Base Rental Revenue Occupied per Square Foot |

| Retail | Village Pointe | 54,246 | 79% | $16.04 |

| Flex/R&D | Richardson Tech | 96,660 | 71% | $9.39 |

| Office | Spectrum Building | 175,390 | 90% | $24.13 |

| 11211 Katy Freeway | 78,642 | 53% | $15.53 | |

| 1400 Broadfield | 102,893 | 72% | $20.57 | |

| 16420 Park Ten Place | 83,760 | 50% | $21.71 | |

| Willowbrook Building | 67,581 | 46% | $14.8 | |

| Timberway II | 130,828 | 57% | $18.26 | |

| One Park Ten | 34,089 | 62% | $15.94 | |

| Two Park Ten | 57,126 | 83% | $20.63 | |

| 3100 Weslayan* | 78,289 | 67% | $18.27 |

*83% tenant in common interest

Financials as of June 2021

Here’s a sample look of one of Hartman’s properties — 11211 Katy Freeway. It’s a 78,000-feet office property located in Houston, Texas. You can view more of Hartman’s owned and managed properties in the Hartman Property Look Book.

Source: Hartman’s Property Look Book

Source: Hartman’s Property Look Book

Hartman’s office sector is the top contributor to its rental revenues. The list also includes the 3100 Weslayan in Houston, Texas which was acquired on December 29, 2020. Hartman has an 83% tenant in common interest for this office property.

The 5 biggest office tenants of the REIT fund are

- Oracle America, Inc.

- Enventure Global Technology Inc.

- Hargrove and Associates, Inc.

- Strategy Engineering & Consulting, LLC

- HDR Engineering

Moreover, 47 leases are going to expire in 2021, which accounts for 40% of the annualized total base rent of the REIT fund.

REIT Performance

Key Performance Metrics Through the Years

The latest NAV price of Hartman vREIT XXI is $10.23 per share for all types of common shares offered. During its IPO in June 2016, the inception NAV price was $10 per share. If you invested early on during its IPO, there would only be a 2.3% increase in capital gain. However, rest assured that Hartman vREIT distributes dividends consistently, which makes total returns more appealing for investors.

As an investor, following the REIT’s financials is part of the due diligence process. Here are 4 of the critical parameters you should look at to measure the company’s operating performance:

- Total Equity — this represents the company’s net worth value. It tells us how big and valuable the company is in the market.

- Total Revenue —this parameter tells us how profitable the company is. How much does the company earn in doing its business?

- Net Income (Loss) — this parameter eliminates all the property operation expenses (e.g. maintenance, insurance, and taxes) from the total revenue. It tells us how much is the take-home pay of the company. Net losses occur either when expenses are greater than income, or when investment losses were greater than the revenue.

- Funds from Operations (FFO) — a common industry standard for reporting REIT operations. Funds from operations (FFO) is the net income excluding depreciation, amortization, impairment of investments, net gains or losses from the sale of real estate, and other unconsolidated entities.

Here’s how Hartman vREIT XXI’s numbers performed throughout the years

| Fiscal Year | Total Equity | Total Revenue | Net Loss | FFO |

| June 2021 (YTD) | $58.65 | $6.47M | ($1.6M) | $1.59M |

| FY 2020 | $61.99M | $13.03M | ($2M) | $4.75M |

| FY 2019 | $66.6M | $7.5M | ($1.085M) | $2.96M |

| FY 2018 | $28.3M | $1.55M | ($1.29M) | $913,000 |

| FY 2017 | $14.3M | $918,000 | ($1.54M) | ($350,000) |

Source: 2020 Annual Report

Throughout the years, Hartman vREIT XXI’s total equity keeps increasing which tells us that the Company is acquiring more properties and minimizing liabilities at the same time.

The total revenue is also increasing — it even almost doubled in 2020 compared to its previous year. However, net losses were consistent every year. According to Hartman, the losses can be attributed to initial start-up costs, operating expenses before making investments, depreciation, and amortization expenses. The net losses in the first half of 2021 were primarily due to electricity expenses from the Winter Storm Uri.

But lastly, although there were net losses, cash flow from daily operations through FFO was increasing starting 2018.

Dividends Distribution History

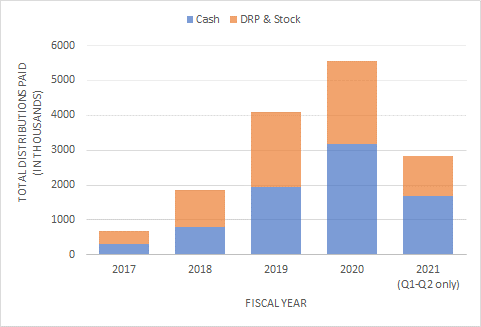

Hartman vREIT XXI has consistently issued monthly distributions since January 2017. However, the distribution frequency in the future is not guaranteed by the Company.

Source: Q2-21 report

Source: Q2-21 report

Despite its net losses, the total distributions made by the Company are increasing every year. Hartman’s long-term policy is to source out dividends from operational cash flow. 38% of its total distributions from inception to March 31, 2021, came from cash flow from operating activities.

Since the FFO is increasing every year, so does the distributions.

But they can also issue distributions from other sources. Sometimes they are distributed as shares of common stock or DRIPs. Investors can maximize these by reinvesting them in Hartman’s DRIP programs for additional shares.

Long-Term Investment Goals

As usual, speculating on how the company’s performance will go in the coming years is more complicated than we think. More so especially now during the uncertain times brought by the COVID-19 pandemic.

However, Hartman remains steadfast with their Company’s vision — to grow the company to $2 billion in assets by 2025, and to $5 billion by 2030.

To gain context on how far the Company has to go, their total assets as of FY 2020 and FY 2019 are approximately $102 million and $90 million, respectively. In less than 5 years, Hartman’s investment portfolio must grow by about 5% to reach its 2025 goal. In comparison, Hartman’s total assets grew by about 17% in 3 years. Although, this happened early on during its inception. So, only time will tell if Hartman achieves these investment goals.