There are 2 ways how investors make money in real estate — through real estate investing and real estate investment trusts (REITs).

Do you wonder how the two differ from each other? Which one is the best method for you to earn an income in real estate? How does investing look like with each method? We’ll be doing a bit of math using real-life examples. So keep reading if you want to learn how to make money work for you in real estate.

Key Takeaways

- The similarity between real estate investing and REITs is that money is invested in residential, commercial, and land properties. The main difference is how investors manage these real estate assets.

- Real estate investing earns income through rentals and selling properties at a more valuable price. Meanwhile, REITs earn income through company dividends and capital gains.

- Benefits of real estate investing: more control over your assets; can own several properties without a lot of money through leverage; offers a lot of tax breaks; a steady stream of multiple cash flows is possible

- The major drawbacks of real estate investing are the handling of tenant problems, property issues, and a lot of decision-making.

- Benefits of REITs: can start with just a few dollars; leave the management of investments to experts; a steady stream of cash flow in the long-term; diversify your investment portfolio, and liquid assets (depending on the type of REIT)

- The major drawbacks of REITs are the taxable income, less control over the assets, and the additional brokerage fees for the fund’s operating costs.

Basics of Real Estate Investing

Real estate investing is buying a property with the end goal of selling it later for a higher price. You make money through capital gains. The other way of earning money is creating a cash flow through rentals. For example, you can choose to rent out your house’s basement space to tenants and charge them your monthly amortization fees. This technique is called long-term leasing, wherein you use other people’s money to pay for your assets.

There are other more ways to real estate investing:

- There’s the passive way where you buy cheap land and hold it until years after when its value has appreciated significantly.

- There’s also house flipping where you buy undervalued properties, repair and modify them, and sell at a higher price.

- Then, there’s also wholesaling where you act as a middleman between the buyer and seller of the house.

Basics of REITs

If you’ve heard of mutual funds, REITs pretty much work that way. REITs are invested in commercial, residential, and land properties. With REITs, you leave out the hands-on experience to the fund managers. Investors involved with REITs earn their shares of rental and interest income from these real estate properties.

There are different types of REITs — most are classified as equity and mortgage REITs. Equity REITs earn income from rentals, while mortgage REITs earn income from interests. The easiest way to buy REITs is through national security exchanges like the New York Stock Exchange (NYSE), where stocks are also traded. Some examples of REITs in the S&P 500 are the American Tower Corporation (NYSE: AMT), Crown Castle International (NYSE: CCI), and Prologis (NYSE: PLD).

Just like stocks, REITs are regulated by the U.S. Securities and Exchange Commission (SEC). Other than in public exchanges, there are also private REITs and public, non-listed REITs.

Historical Returns & Current Trends

Real Estate Returns

How is the real estate market doing? To gauge the growth of the real estate market over the years, let’s look at the 2 effective indicators — home sales and rent prices.

May 2021 data from the National Association of Realtors (NAR) show that the total existing-home sales in the United States were stable from 2017 up until 2020. After the COVID-19 pandemic hit, a sharp decrease in sales was recorded, with its lowest in May 2020. However, as vaccines started to roll out, home sales started to recover, even outperforming the pre-pandemic performance.

Note: Existing home sales account for single-family homes, condos, and co-ops.

Note: Existing home sales account for single-family homes, condos, and co-ops.

Source: May 2021 Existing Home Sales Statistics by NAR

Meanwhile, the graph below shows how rent prices have significantly recovered since the start of the pandemic. According to Realtor.com, there can be many factors to this. People may be more comfortable moving back to the country’s largest cities, or home buyers find for-sale properties to be too expensive. For real estate investors, higher rental rates mean higher cash flow and more choices of tenants.

Source: Rent Prices in the United States by Realtor.com

Source: Rent Prices in the United States by Realtor.com

REITs Returns

The performance of REITs is easier to gauge because there are more standardized data, especially for those that are publicly traded. The graph below shows the historical performance of the total returns of the S&P Global REITs.

Source: June 2021 Data by the S&P Dow Jones Indices

Source: June 2021 Data by the S&P Dow Jones Indices

Even with the abrupt decrease in 2020 due to the pandemic, the trend is gradually getting back on track in 2021. However, compared to stocks, REITs seem to fall short in performance.

REITs or Real Estate Investing: Know the Difference

REITs and real estate investing are both good ways of earning income through real estate. But the question is — which method is a better fit for you? The sooner you dedicate your focus to one thing, the faster you’ll reach your income goals. To help you decide, let’s go through each of the important factors:

| Category / Factor | REITs | Real Estate Investing |

| Control on Assets | Subject to market performance | Hands-on decision making |

| Investor’s Skill | Understands how mutual funds work | Broad scope |

| Investor’s Financial Capability | Can own fractional shares | Must have a sizable capital |

| Investment Time Horizon | Preferably long-term | Can be short or long term |

| Cash Flow | Dividends and capital gains | Rental income or property sales |

| Liquidity | Can be liquid | Less liquid |

| Costs | Front-end and back-end fees | Property upkeep / Sales processing fees |

| Risk Appetite | Diverse | Risky |

| Tax Benefits | May defer tax through Roth IRAs | Offers tax breaks |

1. Control on Assets

You’ll have more control over your assets with real estate investing than in REITs.

In REITs, how fund managers use their pooled money is up to their expert judgment. All you can do is monitor your portfolio’s performance — the rest is subject to the company’s and the market’s performance.

In real estate investing, you choose what property you’re going to buy, how you’ll pay for it, what strategy to use to earn a bigger income, and more. You can choose who your tenants will be and how much to charge them. There’s a lot of room for decision-making with direct real estate investing. However, when the real estate market is down in general, you’ll likely be more affected than with REITs.

2. Investor’s Skill

Generally, it’s easier to get into REITs than in real estate investing.

With REITs, you don’t have to worry about how you should run the properties — that job belongs to the company. But that’s not to say you should enter into REITs without second-guessing. You still have to be diligent with how your fund is performing, how the company charges you, and when to buy and hold your shares.

On the other hand, there’s a broad scope that covers real estate investing. You’ll have to run the numbers yourself. To say that you’ve closed a good deal, what must be the best price? How much should you allocate for the repair and maintenance costs? How much money should you leverage to buy more assets? Plus, you have to be knowledgeable on the state laws that govern where your properties are located. Having a wide network of realtors, title companies, mortgage companies, appraisers, and inspectors helps a lot.

3. Investor’s Financial Capability

Depending on where you buy your REIT shares, investment can range from $5 to $25,000. Publicly listed REITs can be accessed by anyone. Your initial investment is the price of a single share. For example, American Tower Corp is worth around $283. But you can invest lower than that, say $5, to get a fractional share.

According to an article from Forbes, publicly non-listed REITs require a minimum investment between $1,000 to $2,500. Private REITs are the most expensive which can cost around $25,000 or more. Private REITs are accessible to accredited investors only, with a net worth of at least a million dollars.

In real estate investing, your minimum investment depends on the property’s price and your financing option. For starters, your minimum investment is the downpayment of the property — typically at 20% of the market price. But there are more creative financing options. Through leverage, you can buy a property with little to no money — but it takes lots of skill, faith, and risk appetite. Wise investors make use of home equity loans, home equity line of credit (HELOCs), and refinancing.

4. Investment Time Horizon

Both real estate investing and REITs can either be short- or long-term investments.

For real estate investing, you can do short-term investments through wholesaling (which can take days only) or house flipping (in a matter of months). Or you can also do long-term investing through leasing your property for as long as your tenants can pay.

For REITs, you can do short-term investments but it’s not advisable. Earning profitable dividend income from REITs takes time. Remember, you don’t have much control over your assets so short-selling may be counterproductive. REITs are more associated with retirement investments through Roth IRAs. This will be discussed more in the category of tax benefits.

5. Cash Flow

REITs are required to distribute 90% of their taxable income to their shareholders. Just like stocks, investors earn income in REITs through dividends and capital gains. According to Millionacres, equity REITs have an average dividend yield of around 5%, while mortgage REITs are around 10%.

Publicly traded REIT dividends by subsector (2020 Data from Nareit)

Publicly traded REIT dividends by subsector (2020 Data from Nareit)

Source: Millionacres

In real estate investing, the cash flow varies depending on the investor’s skill. Real estate investors earn through rentals and or property sales. Rental income comes monthly, while property sales come here and there with sizable checks.

6. Liquidity

Both real estate investing and REITs are illiquid investments, except for publicly-traded REITs.

If it’s with publicly-traded REITs, you can easily convert your shares to cash by selling them. Just like how you do with stocks. But with public non-traded and private REITs, there are withdrawal restrictions and holding periods.

Real estate investing is also illiquid because you’re dealing with large amounts of money associated with property prices. It may take months to years for your customers to shell out and transfer the cash to you.

7. Costs

Relatively, real estate investing is more costly than REITs.

In real estate investing, there are a lot of costs to think of such as:

- repair costs

- construction

- insurance

- homeowner’s association fees

- home inspections

- home appraisals

- property taxes

- utilities

- closing fees

- moving fees

- realtor fees

For publicly traded REITs, you have to prepare for the brokerage fees. Some brokers like Charles Schwab do not impose fees on commissions, account opening, maintenance, and money transfer fees. But for non-traded REITs, front-end fees can reach as much as 15% of the share price plus organizational costs, according to FINRA. Back-end fees may also be charged.

8. Risk Appetite

If I were to rank the risk appetite from most risky to least risky, it would be:

Real estate investing > Private REITs > Public, non-traded REITs > Publicly traded REITs

For more info on the difference among these types of REITs, check out this good comparison by Nareit.

9. Tax Benefits

Real estate investing has more tax benefits compared to investing in REITs.

REITs dividends are taxable at a maximum rate of 20% and 39.6% for ordinary income and capital gains, respectively. Actual rates vary depending on the investor’s tax bracket. But there is a way to bypass taxable costs — by opening a Roth IRA account.

A Roth IRA account is a retirement account where you can make after-tax contributions. You can open a Roth IRA account through a broker or a bank. When you buy REITs into a Roth IRA account, your dividends, investments growth, and withdrawals are tax-deferred. Just make sure to qualify for these 2 requirements:

- You must be at least 59.5 years old upon withdrawal

- The account should be at least 5 years old.

On the other hand, there are numerous tax-break opportunities in real estate investing. Some examples are:

- Deductions on costs associated with managing a property — e.g. repair and maintenance fees, property taxes, insurance fees, mortgage interests, utilities, and advertising

- Pass-through deductions care of the 2017 Tax Cuts and Job Act. Investors can deduct 20% of their income tax rate until 2025.

- Depreciation costs can be deducted. According to Fortune Builders, the IRS allows a tax deduction on residential properties older than 27.5 years old, and commercial properties older than 39 years old.

The pros and cons of real estate investing and REITs are summarized in the table below:

| Pros | Cons | |

| REITs | ✓ Favorable for passive investors

✓ Anyone can easily invest in REITs with just a few dollars ✓ More liquid ✓ Some brokers have zero fees ✓ A good way to diversify your investment portfolio |

X Private REITs and public, non-traded REITs have withdrawal restrictions. They also have higher transaction fees.

X Investment income depends on the company’s performance X Dividends are still taxable, except when bought with a Roth IRA account |

| Real Estate Investing | ✓ More control over your assets

✓ More opportunities for income through rent and sales ✓ Offers huge tax breaks ✓ May opt for creative financing options |

X Requires time and energy for hands-on decision making

X Riskier X Illiquid investment X Must have a sizable capital |

Real Estate Investing vs. REITs Example Numbers

Now, let’s work on examples of how investing works for each field.

Real Estate Investing — Example

For real estate investing, let’s assess the cap rate and the cash-on-cash return.

- Cap rate tells you how much the property is going to profit you when you fully paid for it in cash. According to Nolo, a reasonable cap rate ranges between 4 to 10%.

Cap Rate = Net Annual Operating Income/Purchase Price or Property’s Market Value * 100

- Cash-on-cash return tells you how much income you’re getting relative to the total cash you’ve invested. This is applicable when you purchase the property through financing options.

CoC = Net Annual Cash Flow/Total Cash Invested

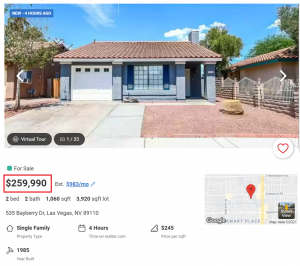

For this example, let’s look at this listed single-family home property with 2 beds and 2 baths in Las Vegas, Nevada:

Screenshot taken from Realtor.com

Screenshot taken from Realtor.com

This property has a current market value of $259,990.

Case 1: You bought the full price of the property in cash. You are looking for tenants to generate cash flow.

| Purchase Price | $259,990 |

| Monthly Rent | $1,750 |

| EXPENSES (monthly) | |

| Tax | $141 |

| Insurance | $69 |

| Vacancy (5% of the rent) | $85 |

| Repairs | $217 |

| Property Management (10% of the rent) | $170 |

| TOTAL MONTHLY EXPENSES | $682 |

- Monthly Rent: Based on the Las Vegas rental price data by Zumper, the median rent is approximately $1,750.

- Tax: According to SmartAsset, the monthly property tax is estimated to be $141.

Screenshot taken from Smart Asset’s Property Tax Calculator

Screenshot taken from Smart Asset’s Property Tax Calculator

- Insurance: According to Bankrate, the average cost of home insurance in Nevada is $822/year which is equivalent to $69/month.

- Repairs: As a rule-of-thumb, a property owner must allocate 1% of the property value annually for repair costs. That’s equivalent to $217/month.

Let’s calculate the cap rate:

Cap Rate = [($1,750 – $682) x 12] / $259,990 x 100 = 4.9%

This is a good investment since your cap rate is in the reasonable range.

Case 2: You bought the property through a loan. You are looking for tenants to generate cash flow.

To simulate the financing costs, see the mortgage calculation below:

Screenshot taken from Google’s mortgage calculator

Screenshot taken from Google’s mortgage calculator

Here’s how you calculate for the cash-on-cash return:

| Purchase Price | $259,990 |

| Monthly Rent | $1,750 |

| FINANCING | |

| Downpayment (20% of Purchase Price) | $51,998 |

| Closing Costs | $4,000 (estimate) |

| TOTAL INVESTMENT | $56,188 |

| EXPENSES (monthly) | |

| Mortgage (including taxes and fees) | $1,254 |

| Vacancy (5% of the rent) | $85 |

| Repairs | $217 |

| Property Management (10% of the rent) | $170 |

| TOTAL MONTHLY EXPENSES | $1,726 |

CoC Return = [($1,750-$1,726) x 12] / $56,188 x 100 = 0.5%

From the calculations, it looks like this would not be a profitable investment. Anyway, these are just rough calculations. There are more comprehensive and downloadable spreadsheets online that you can use.

But in this case, one way to increase your returns is to pay a bigger down payment to reduce mortgage costs. Or you can also choose to increase your monthly rentals. As a real estate investor, you have more control over your assets.

REITs — Example

Analyzing your return on REITs is straightforward especially if you invest in publicly-traded REITs.

As an example, let’s look at the Vanguard Real Estate Index Fund ETF (ARCA: VNQ). REIT ETFs are a good way to diversify your portfolio.

Screenshot taken from Investagram

Screenshot taken from Investagram

Case 1: Dividend Yield

When you search for VNQ’s list of issued dividends, the latest quarterly dividend was issued on June 29, 2021, at $0.729/share. For a rough estimate, multiply it by 4 to get to an annual dividend income of $2.916/share.

If the current price of NLY is $105.85/share. You can now calculate your REIT’s yield:

Yield = Annual Dividend Income per Share / Current Share Price x 100

Yield = $2.916 / $105.85 x 100 = 2.75%

Case 2: Capital Gains

Suppose you bought VNQ shares since inception (2004) at a price of $24.88/share. If you’re going to sell your shares now at the current price of $105.85, your long-term investment would increase by a whopping 325%!

Capital Gain = (Current Value – Original Value) / Original Value x 100

Capital Gain = ($105.85 – $24.88) / $24.88 x 100 = 325%

Bottomline: Which Investing Method Suits You?

To conclude, both real estate investing and REITs are good investments. But if you only have to choose one:

Choose real estate investing if you think you’re someone who:

- Has extensive knowledge of how the real estate market works

- Wants to have more control over your cash flow and the way you manage your assets

- Not in urgent need of liquid cash or more focused on growing your real estate business

- Has a sizable capital. Or if not, someone who’s comfortable with buying properties through leveraging (a.k.a good debt)

Choose REITs if you think you’re someone who:

- Doesn’t want to exhaust a lot of time and effort into directly managing real estate investments

- Wants to earn a steady stream of cash flow through dividends and capital gains no matter how small they are

- More comfortable with a diversified portfolio of real estate assets

- Thinks of investing in real estate for your retirement fund