Summary

- Vanguard Real Estate Index Fund tracks to the MSCI US REIT Index.

- Gradual appreciation overtime, and above average dividend yields are the fund’s objectives.

- The fund has returned 21.73% year to date as of 6/30/2019, 10.23% since inception in 1996.

- The portfolio is diversified across 189 equity REITs, including many top performers.

- Certain shares feature an expense ratio of 0.12%, well below the peer average of 1.21%.

Overview

Vanguard’s Real Estate Index Fund (VGSLX) is a mutual fund that invests in various types of REITs including office, healthcare, hotel and other equity REITs, as well as real estate management companies and development firms. Specifically, the fund owns stock in 189 different companies with total net assets of $64.2 Billion. Founded in 1996, the fund is managed by Vanguard’s Equity Index Group.

How the Fund Works?

According to Vanguard, the objective of the Vanguard Real Estate Index Fund is to provide high income and moderate long-term capital growth by investing in stocks issued by commercial REITs. The risk profile of the fund is rated slightly above average.

The mutual fund tracks to the MSCI US REIT Index, which means that it invests in REITs included in the index, and benchmarks to the index as a relative measure of the Fund’s performance. Professional investment managers use Vanguard’s proprietary software and professional expertise to evaluate REITs included in the index and make investment determinations according to potential for return, and threshold for risk.

The value of the mutual fund’s shares is tied to the daily net asset value (NAV) of the fund. As dividends are paid by the underlying REIT investments, proceeds are distributed to investors as dividends quarterly. The NAV of the fund grows as the value of the underlying investments increase.

Investing in the Fund

There are several ways to invest in the Vanguard Real Estate Index Fund, including:

- Admiral Shares (VGSLX)–These shares require a minimum investment of $3,000 and offer investors a lower fee structure. Vanguard only offers this low fee share class across a select group of mutual funds, which features an average expense ratio of .12%, well below the average ratio of 1.21% among similar funds.

- Investor Shares (VGSIX)–Investor shares were previously offered by Vanguard. However, Vanguard is in the process of transitioning all Investor Shares to Admiral Shares. Investors may transition shares themselves, or they may allow Vanguard to transition them gradually over the course of a year. The only difference in the share types are fees charged by Vanguard.

- ETF Shares (VNQ)–Investors may buy ETF shares with no minimum investment.

- Institutional Shares (VGSNX)–Require a minimum initial investment of $5,000,000 and offers an even lower fee structure than Admiral Shares. Institutional shares have an average expense ratio of .05%.

Portfolio

The portfolio is well diversified and made up largely of the fund’s ten largest holdings which are listed below. Each company listed below is a top performing publicly traded REIT with a high-quality portfolio, and a consistent track record of dividend payments. Vanguard Real Estate Index Fund II is similar in composition to the Vanguard Real Estate Index Fund I, but is designed for institutional investors, as the minimum investment is $100 M. Fund II includes the same top holdings, only adding SBA Communications as #10 to the list below. As of 6/30/2019, 42.1% of Fund I’s total net assets are invested in the fund’s ten largest holdings:

Vanguard Real Estate Index Fund II

American Tower Corp

Crown Castle International Corp

Prologis, Inc

Simon Property Group, Inc

Equinix, Inc

Public Storage

Welltower, Inc

Avalon Bay Communities, Inc

Equity Residential

Vanguard Global ex-US RE Index Fund (VGRNX)

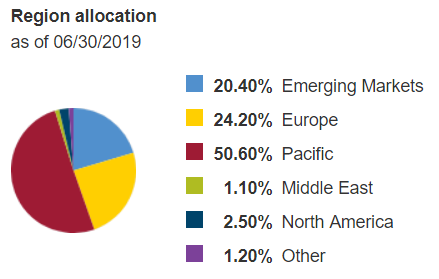

Vanguard also offers a similar fund that invests in international REITs and real estate companies. The $6.8B fund is considered high risk by Vanguard. The fund owns stock in 631 companies, predominantly in Pacific markets, including China and Japan, and emerging markets. The Fund is subject to currency volatility, due to the nature of international investments. (Vanguard, 2019)

The fund has generated a 5.80% average annual return since inception in 2011. This is favorable in comparison to the S&P 500 ex US Property Index. Similar to the Vanguard Real Estate Index Fund, VGRNX also benefits from a very low expense ratio .11%, compared to an average for similar funds of 1.10% according to Vanguard.

The fund has generated a 5.80% average annual return since inception in 2011. This is favorable in comparison to the S&P 500 ex US Property Index. Similar to the Vanguard Real Estate Index Fund, VGRNX also benefits from a very low expense ratio .11%, compared to an average for similar funds of 1.10% according to Vanguard.

Fund Benefits

Diversification, convenience and professional management are all benefits of investing in mutual funds, the same is true of the Vanguard Real Estate Index, with the added benefit of a below average expense ratio. An added benefit of the VGSLX fund is lower fees. Admiral Shares of the Fund have an expense ratio of .12%, compared to an industry average of 1.21%. According to Vanguard, this would result in a $2,430 savings to an investor over 10 years on an investment of $10,000. Total fees for the 10-year hold would amount to $283 vs. $2,713 among similar funds. (Vanguard, 2019)

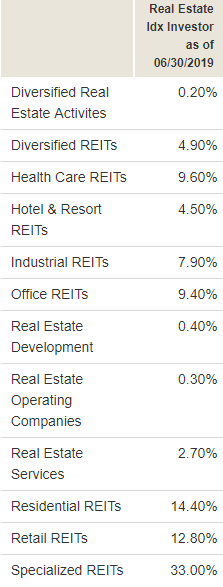

The fund invests specifically in equity REITs, so mortgage REITs are not included in the portfolio composition. However, the Fund is well diversified across asset classes with the following allocations:

Fund Risks

Fund Risks

The greatest risk involved in the Vanguard Real Estate Index Fund is industry concentration risk because all of the investments made by the fund are within the same industry. An economic or regulatory change could potentially have a negative impact on the broader real estate industry, and many of the company’s held by the fund. For example, a tax policy change or a severe economic recession could negatively impact operation of the underlying REITs, which would likely result in lower share prices and potentially threaten the REITs ability to pay dividends.

The Fund is broadly diversified across industries, and while real estate concentration risk is a concern, the Fund mitigates it to the extent possible through diversifying among REIT subsectors. For example, healthcare REITs, which are commonly regarded as recession proof, comprise almost 10% of the Fund’s portfolio. Specialized REITs, which often include data centers, cell phone towers and other infrastructure REITs, are also somewhat insulated from economic volatility.

Vanguard also warns investors of the risk associated with investing in a fund that consists almost entirely of stock investments. These investments in stock tend have much higher rates of volatility than other investment types. According to the prospectus, an investment in the Fund is best suited for investors with an anticipated hold period of 10+ years.

Should I Invest in Vanguard Real Estate Index Funds?

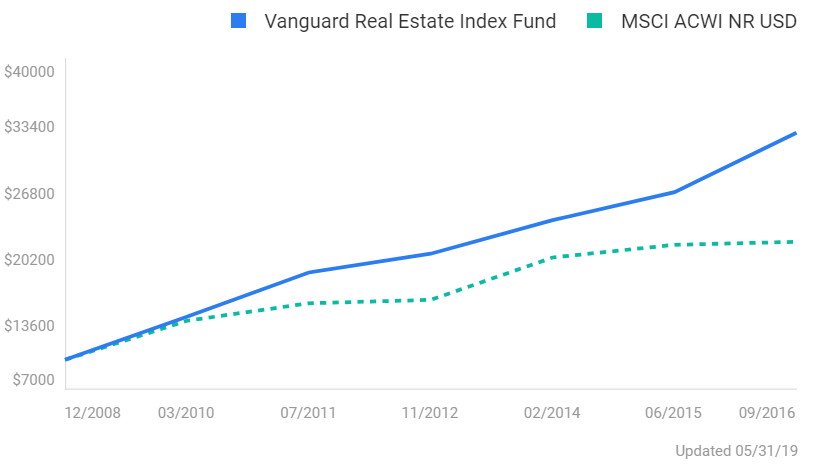

The fund has returned 21.73% year to date as of 8/2/19, 12.98% over the last year, 3.01% over 3 years, 7.87% over 5 years and 10.23% since the Fund’s inception in 1996, which in the shorter term outperforms the S&P 500 due favorable performance of REITs. Over the longer term (3-10 years) the index has performed generally in line with the S&P 500. (US News, 2019)

Investment in the Vanguard Real Estate Index Fund is ideal for investors interested in investing in the real estate sector. Performance of the Vanguard Real Estate Index Fund consistently performs favorably to the MSCI US REIT Index to which it tracks. The Fund is designed to generate above average dividend yields, and gradually appreciate over time along with low expense ratios. Also to note, according to Vanguard the Fund is designed for investors with an anticipated hold period greater than 10 years.

Investment in the Vanguard Real Estate Index Fund is ideal for investors interested in investing in the real estate sector. Performance of the Vanguard Real Estate Index Fund consistently performs favorably to the MSCI US REIT Index to which it tracks. The Fund is designed to generate above average dividend yields, and gradually appreciate over time along with low expense ratios. Also to note, according to Vanguard the Fund is designed for investors with an anticipated hold period greater than 10 years.