Key Takeaways

- Whitestone REIT is an equity REIT that’s publicly traded in the NYSE in the retail and office sectors. It invests mainly in shopping and entertainment centers and finding tenants that can provide the daily necessities, needed services, and entertainment to the community.

- Whitestone REIT owns, manages, and leases out a total of 59 Community Centered PropertiesTM around Arizona, Illinois, and Texas. Their target market is in fastest-growing population growth in the Sunbelt states with high household income.

- About 40% of Whitestone REIT’s outstanding shares are from public investors.

- During the height of the pandemic in March 2020, the price dropped by about 50% — from around $12 down to $6. For the rest of 2020, the market price has leveled out and stabilized. Then, it started recovering as we approach 2021.

- When compared to 16 publicly traded U.S. shopping center REITs, the average 5-year total shareholder return was -5.95%. Among the group, Whitestone REIT ranked 4th with 8.3% TSR.

- Since WSR started trading in August 2010, it has issued out 128 consecutive monthly dividends (through May 4, 2021)

Company Background

Whitestone REIT is a real estate investment trust company that owns, manages, leases, and develops commercial and business properties in fast-growing cities mainly in the Sunbelt region. Their retail and office spaces are located strategically in densely populated neighborhoods with high household income and a highly educated workforce. Their community-centered approach is what they proclaim to be their winning consumer-driven business model wherein they consider the success of their tenants as their own.

Whitestone REIT is a real estate investment trust company that owns, manages, leases, and develops commercial and business properties in fast-growing cities mainly in the Sunbelt region. Their retail and office spaces are located strategically in densely populated neighborhoods with high household income and a highly educated workforce. Their community-centered approach is what they proclaim to be their winning consumer-driven business model wherein they consider the success of their tenants as their own.

Whitestone REIT was formerly known as Hartman Commercial Properties REIT under the leadership of then-CEO Al Hartman from 1998 to 2006. Upon the change of leadership in 2007, the name was changed to what we now know as Whitestone REIT. Their headquarters is located in Houston, Texas, but they also have offices in Arizona, Dallas-Fortworth, Austin, and San Antonio.

Whitestone REIT Type

Whitestone REIT falls under publicly traded, equity type of REIT in the retail and office sectors.

Publicly-traded REIT

In terms of how it’s traded, Whitestone REIT is a publicly traded REIT in the New York Stock Exchange with the ticker symbol WSR (NYSE:WSR). A company can accept retail investors by going public through an initial public offering. Whitestone REIT’s IPO was announced in August 2010 with 2,200,000 shares at $12/share.

It’s officially registered with the Securities and Exchange Commission (SEC) and it’s obliged to divulge its financial reports periodically to the public. Any interested party can check out how they’re doing financially through their company website or SEC reports.

Equity REIT

In terms of asset type, Whitestone REIT is an equity REIT. Equity REITs own their properties and lease them out to tenants. They pay out dividends to their investors from rental income. Whitestone REIT has consistently issued monthly dividends since 2010.

Retail and Office REIT

In terms of sector, Whitestone REIT is into a mixed use of retail and office spaces. Their properties cater to the community’s daily necessities, needed services, and entertainment with open-air designs and expandable square footage. Something that just can’t be provided by eCommerce. Target demographics are in high household income neighborhoods and areas with increased job growth.

What the Fund Invests in

Community Centered PropertiesTM

Whitestone REIT invests in Community Centered PropertiesTM — a term they trademarked since 2010. In their 2016 annual report, they defined their real estate investments as:

“…visibly located properties in established or developing culturally diverse neighborhoods in our target markets. We market, lease and manage our centers to match tenants with the shared needs of the surrounding neighborhood. Those needs may include specialty retail, grocery, restaurants and medical, educational and financial services.”

As of this writing, Whitestone REIT owns, manages, and leases out a total of 59 Community Centered PropertiesTM around Arizona, Illinois, and Texas.

| State | Cities | Number of Properties |

| Arizona | Anthem, Carefree, Chandler, Fountain Hills, Gilbert, Mesa, Phoenix, Scottsdale | 25

(19 retail, 5 office, 1 mixed) |

| Texas | Austin, Dallas-Fort Worth, Frisco, Houston, Irving, Keller, McKinney, Pasadena, Plano, San Antonio, Sugarland | 33

(25 retail, 5 office, 3 mixed) |

| Illinois | Buffalo Grove | 1

(retail) |

| TOTAL | 59 | |

Acquisition Criteria

Whitestone REIT also plans on expanding its scope in potential locations in the Southwestern and Western regions. Florida, Georgia, North Carolina, Tennessee, and Colorado are just some of the potential locations they’ve mentioned in their recent 2021 Q1 investor presentation.

Aside from owning and managing real estate properties, Whitestone REIT is also on the lookout for mismanaged, overleveraged, and foreclosed properties that they can redevelop into income-producing and community-oriented retail and office spaces.

Here are a few of their acquisition criteria:

- Fast-growing cities around the Sunbelt region

Their target market is in U.S. cities that are part of the top 15 metro areas with fast population growth. For example, the estimated 5-year MSA population growth rate (2017-2022) in Dallas-Fortworth is 9.7%.

- High household income neighborhoods

This will lead to high consumer spending which can boost the market value of its properties.

- Open-air designs and expandable square footage

The design of Whitestone REIT’s properties is more on open-air, luxury type of commercial lifestyle living. They encourage go-to places where neighborhoods within the 5-mile radius can connect by designing a lot of gathering areas that eCommerce couldn’t provide.

The Shops at Starwood (Frisco)

The Shops at Starwood (Frisco)

- Entrepreneurial tenants that provide community services beyond eCommerce

Whitestone REIT invests in infrastructure and finding tenants that can provide the daily necessities, needed services, and entertainment to the community. It is a core essential in the consumer-driven business model of Whitestone REIT to aid the success of its tenants. When it comes to tools that tenants may need, they are hands-on because they consider the success of their tenants as their own.

As of the Q2 2021 earnings report, Whitestone REIT has a total of 1,440 tenants with an occupancy rate of 89.9%.

Real Estate Investment Portfolio

Tenant Mix

The real estate investment portfolio of Whitestone REIT consists of a mix of office and retail services — retail being the most of it. Consumer psychographics plays a huge role in Whitestone’s investment strategy. So whatever the consumer behavior dictates through analytics and interviews, that’s where their business goes.

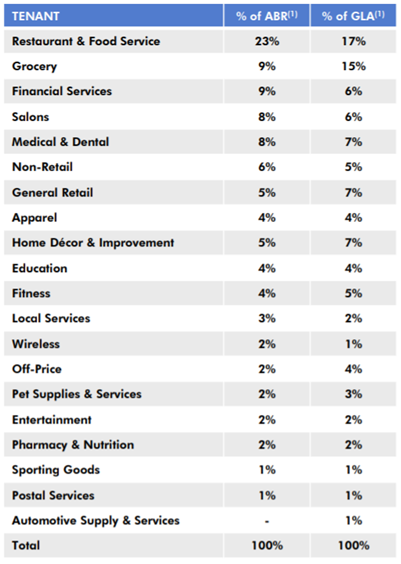

Some of Whitestone’s tenants are Whole Foods Market, Walgreens, Petco, CrossFit, Wells Fargo, Starbucks, Kumon, and more. The table below shows the category distribution of tenants with corresponding percentages of annual base rent (ABR) and gross leasable area (GLA).

Screenshot taken from Q1 2021 Investor Presentation

Screenshot taken from Q1 2021 Investor Presentation

Who invests in Whitestone REIT?

Screenshot taken from Seeking Alpha

Screenshot taken from Seeking Alpha

More than half (~53%) of Whitestone REIT shareholders are institutional investors. These are the asset management companies that invest the pooled money from their clients. According to CNN Business, these are the top 5 institutional investors of Whitestone REIT:

- BlackRock Fund Advisors (~$51M)

- The Vanguard Group, Inc. (~35M)

- SSgA Funds Management, Inc. (~12M)

- Geode Capital Management LLC (~7M)

- Dimensional Fund Advisors LP (~5M)

Next to the institutional investors are the retail investors (~40%) or the small investors who bought their shares through NYSE. And lastly, the remaining percentage comes from the individual investors (6%). These are the insiders of the company coming from its Board of Trustees and Senior Management.

Performance Outlook

WSR Price History as of 4:10 AM CST August 4, 2021 NYSE via Reuters

WSR Price History as of 4:10 AM CST August 4, 2021 NYSE via Reuters

Historical Price Chart

NYSE:WSR started trading on August 26, 2010 at $12 per share. Now, 11 years later, WSR is priced at $8.83. If you bought WSR shares back in 2010 during its IPO, there would be a portfolio loss of -26%.

Understandably, retail stores were heavily affected by the lockdown restrictions of the pandemic. During the height of the pandemic in March 2020, the price dropped by about 50% — from around $12 down to $6. For the rest of 2020, the market price has leveled out and stabilized. Then, it started recovering as we approach 2021.

Key Performance Metrics Through the Years

The stock price history chart does not tell you the full story. You have to also run the numbers and see how the company managed its investments through the ups and downs of the business cycle. Here are 5 of the critical parameters you should look at to measure the company’s operating performance:

- Market Capitalization — this is the per-share price of the stock in the market multiplied by the company’s total outstanding shares at a certain time. It tells us how big and valuable the company is in the market.

- Total Revenue —this parameter tells us how profitable the company is. How much does the company earn in doing its business?

- Net Operating Income (NOI) — this parameter eliminates all the property operation expenses (e.g. maintenance, insurance, and taxes) from the total revenue. It tells us how much is the take-home pay of the company.

- Funds from Operations (FFO) — a common industry standard for reporting REIT operations. It’s the net income available to common shareholders as defined by NAREIT.

- Dividend Payout Ratio — it tells us how much of the company’s net income is paid back to its investors in the form of dividends.

With all of those parameters defined, the table below gives you a picture of how well the company has managed its operations since it became public in 2010 up to the present.

| Market Cap ($ millions) | Total Revenue

($ thousands) |

NOI

($ thousands) |

FFO

($ thousands) |

Dividend Payout Ratio | |

| Q2 2021 (YTD) | 376.97 | 59,993 | 41,182 | 19,443 | 143.33 |

| FY 2020 | 337.86 | 120,939 | 78,739 | 36,375 | 300 |

| FY 2019 | 565.12 | 121,186 | 81,491 | 38,026 | 200 |

| FY 2018 | 487.68 | 123,009 | 81,424 | 39,398 | 219.23 |

| FY 2017 | 565.19 | 126,369 | 83,849 | 35,045 | 518.18 |

| FY 2016 | 423.76 | 104,866 | 70,345 | 27,031 | 438.46 |

| FY 2015 | 324.17 | 93,729 | 62,081 | 26,696 | 475 |

| FY 2014 | 345.05 | 72,472 | 47,230 | 21,920 | 356.25 |

| FY 2013 | 293.39 | 62,281 | 38,635 | 17,314 | 570 |

| FY 2012 | 238.05 | 46,844 | 28,915 | 10,273 | NM |

| FY 2011 | 136.11 | 35,375 | 21,588 | 8,707 | 950 |

The numbers show that Whitestone REIT’s first year of being public was the least performing throughout the years. But despite that, much of the dividends were given back to its first investors. Meanwhile, its peak operating performance was in 2017, with 2018 coming close to second.

In 2020, the total revenue, FFO, and NOI were quite comparable to 2017’s numbers. But the market capitalization noticeably went down probably because a lot of investors may have panicked and withdrawn their shares before the price plummets down further. But despite the price action, the company handled the economic downturn well.

How Did Whitestone REIT Perform Compared to Its Peers?

Whitestone REIT’s unique value proposition is their culturally diverse retail centers that connect the community which eCommerce couldn’t provide. But unfortunately, this unique value proposition did not work with the situation of the pandemic. Hence, all retail sectors in the real estate industry were affected. But how did Whitestone REIT perform compared to its peers?

Screenshot taken from Q1 2021 Investor Presentation

Screenshot taken from Q1 2021 Investor Presentation

When compared to 16 publicly traded U.S. shopping center REITs, the average 5-year total shareholder return was -5.95%. Among the group, Whitestone REIT ranked 4th with 8.3% TSR. Most importantly, WSR has above-average returns in the same sector.

Dividend History

Since WSR started trading, it has issued out 128 consecutive monthly dividends (through May 4, 2021). The highest dividend recorded was in 2016. In 2020, dividends were significantly lower due to the effects of the pandemic.

Screenshot taken from Q1 2021 Investor Presentation

Future Estimates from Analysts

Coming up with future estimates is not my strongest suit and I leave that all to the experts who have access to more sophisticated tools. For detailed analysis on performance outlooks, sites like Seeking Alpha are good resources for your investment research. Below are their estimated charts on revenue and FFO for this year through the end of 2022.

Source: Seeking Alpha – Whitestone REIT

Source: Seeking Alpha – Whitestone REIT

Source: Seeking Alpha – Whitestone REIT

Source: Seeking Alpha – Whitestone REIT

Whitestone REIT’s 5-Year Long Term Goals

But ultimately, the huge indicator of the direction on where this investment will be leading to is anchored on the company’s long-term goals. In 2018, the company released an open letter to its shareholders to share their long-term financial goals and growth strategies.

By 2023, they’re working to achieve the following goals:

- Become a leading provider in fulfilling neighborhood consumer needs in the fastest-growing, business-friendly cities with high household income

- Reduce leverage by attaining a Net Debt to EBITDA ratio between 6 to 7

- Improve their general and administrative expense-to-revenue ratio ranging between 8%-10%

- Continue to increase market presence in the Sunbelt states

- Improve cash flow to increase dividend payout ratio for the shareholders

- Support the growth of their future leaders and managers through their Real Estate Executive Development program