Overview

- Data Center REITs own and manage facilities that are used to safely store data.

- Global data center and cloud IP traffic are forecast to triple by 2021, with a projected CAGR of 25%. (CBRE, 2019)

- Total Market Cap:

- Data Center REITs: $73,888

- All REITs: $1,087,402 (NAREIT, 2019)

- Datacenter demand continues to grow due to the evolution of cloud computing, e-commerce, and the “internet of things”.

- Northern Virginia accounted for 67% of the data center construction pipeline in 2018. (CBRE, 2019)

- Data Center REITs trend more with the tech sector, as opposed to the REIT sector.

What are Data Center REITs?

In 2016, the digital economy made up about 20% of global GDP, by 2021 it is expected to be 25% (Accenture Strategy, 2016), that number seems astounding, but layer in the constant evolution of new technology and a real estate component, and the data center REIT subsector can be difficult to understand. Without getting too deep into the technology of these real estate entities, I’ve outlined a few data center tech terms below:

- Colocation: Is an offsite home for a company’s data and server equipment. The data center provides the building, HVAC, power, bandwidth, and physical security; the tenant supplies the servers and equipment.

- Interconnection: Is the degree to which digital data can be shared securely. Value components of interconnection include the geographical distance between data and its end-user, and the volume of data traveling across networks. In both cases, less is more.

- Redundancy: Is a measure of how much backup power capacity is available at a data center site. If a site has redundancy of N+1, the site has uninterruptable power supply (UPS) capacity for all users, plus one redundant UPS unit as backup. The greater the redundancy measure, the less likely the servers will incur downtime.

- Kilowatts (kW) and Megawatts (MW)-Data center capacity is measured in energy capacity, which is measured in kW hours and MW hours. Datacenter customers lease kW and MW hours, rather than physical space. To put this metric in perspective, a typical regional power plant produces 500MW, one MW hour is made up of 1,000kw hours.

Google is the largest consumer of data; Microsoft, Facebook, governments and health care conglomerates are also massive consumers. The growth leaders in data capacity demand are e-commerce providers and video-on-demand services like Netflix. Continued growth is expected to come from these same providers, but also from evolving technologies, such as the “internet of things”, artificial intelligence, self-driving cars and the deepening trend toward cloud-based services.

Due to the sensitive, and often proprietary nature of the data that is stored in data centers, it’s customary that a data center lease includes a provision for confidentiality and non-disclosure. Tenant quality is traditionally a metric used by REIT investors to evaluate the quality of a portfolio; however, this information is not publicly available for data centers. As a result, the portfolio quality variable tends to flow more consistently with the broader tech industry.

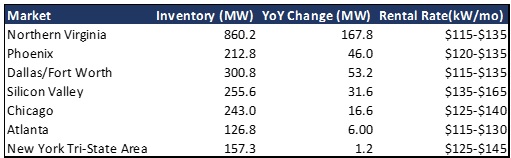

Data Centers tend to be located in industrial areas in close proximity to tenant companies to minimize the networks data must pass through to reach the end-user. Northern Virginia (NV) is, by far, the largest US market for data centers. NV continues to develop at a pace that includes 67% of all data center construction in the US and is 5 times the construction occurring in the next closest city by volume, Phoenix. (CBRE, 2019) Much of this growth can be attributed to Amazon’s HQ2 plans for the region, as well as government demand. Lake Side Technology Center in Chicago is owned by Digital Realty Trust and is the largest data center in the world. Lake Side leases space to more than 70 users. Below is a table detailing top data center markets, market inventory and a range of rental rates per kW/month.

A four-tier scale measures the level of service provided at a facility, and determines the rate charged by data centers. The tiers are detailed below:

Tier I: Basic Capacity

- At least one uninterruptable power supply (UPS) system

- Dedicated cooling equipment that runs continuously.

- Designated power generator that protects the system from extended power outages.

- Basic site infrastructure guaranteeing 99.671% availability.

Tier II: Redundant Capacity Components

Provides an increased margin of safety against infrastructure failure, and redundancy allows some maintenance to be done on-site without incurring downtime.

- Redundant UPS systems.

- Backup Generators

- Dedicated cooling equipment that runs continuously.

- Guarantees 99.741% availability.

Tier III: Concurrently Maintainable

Builds on Tier II offerings, but Tier III facilities do not require shut down when repairs need to be made or equipment needs to be replaced, and also includes the following additional features:

- Alternate delivery channels for power and cooling systems.

- Concurrently maintainable site infrastructure guaranteeing 99.982% availability.

Tier IV: Fault Tolerance

- Builds on Tier III features but incorporates fault tolerance in site infrastructure topology.

- Fault tolerance ensures the continuity of IT operations, despite individual equipment failures, or interruption in distribution paths.

- This is the highest level in the data center properties classifications and is usually what is sought after by multinational corporations offering critical IT systems.

- Fault-tolerant site infrastructure with electrical power storage and distribution facilities guaranteeing 99.995% availability.

(Uptime Institute, 2019)

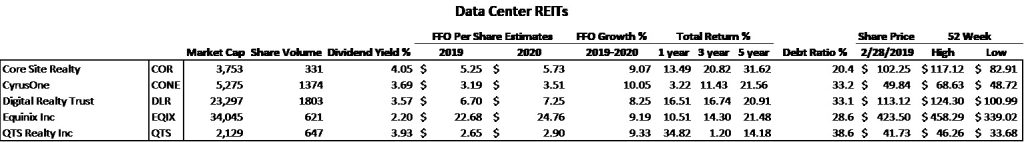

Performance of Data Center REITs

Total returns for the Data Center REIT sub-sector have averaged 21.95% over the last 5 years, and 15.71% over the last 12 months, which comes predominantly from growth in share price. The average dividend yield is well below the broader REIT sector at 2.93%, while the sector averaged 4.12% for the same period. Data Center REITs have outperformed the broader REIT sector over the last five years, as well, and are expected to perform favorably as data center demand and economic conditions remain positive.

Data Center REITs suffered a bit of a rough patch in 4Q18, as investors feared over-building in the sub-sector as many of the REITs began construction of speculative projects. Share prices continue to recover, and much of the under-construction space is preleasing at a rate faster than previously expected. The national vacancy rate for data centers is 11%, concentrated primarily in NV and Houston, where positive absorption is expected to continue. (CBRE, 2019)

Pros and Cons of Data Center REITs

Pros

- Data Centers are a fundamental necessity to the massive growth in data and technology occurring globally.

- Global data center and cloud IP traffic are forecast to triple by 2021, with a projected CAGR of 25%. (CBRE, 2019)

- Industries far beyond tech are digitizing and becoming more reliant on data. Industries such as healthcare, financial services and the government still have a long way to go in storing and compiling data.

- Data Centers have historically held up well during recessionary periods.

- Due to the high capital costs associated with data centers, leases tend to have long lease terms.

Cons

- The favorable outlook for data centers has led to quite a bit of development by smaller players, which may put downward pressure on rates at some facilities in the short term.

- The subsector has been subject to periods of volatility for a variety of reasons.

- As REITs, the subsector is also sensitive to rising interest rates.

- The complicated nature of data centers and evolving technology can be difficult to fully understand.

- REITs are constantly seeking an equilibrium in facility supply and leasing demand.

Outlook for Data Center REITs

Global data center and cloud IP traffic are forecast to triple by 2021, with a projected CAGR of 25%. (CBRE, 2019) The colocation market grew 10% in 2018 and is expected to continue a similar trajectory for the foreseeable future. (Synergy Research, 2019) While concerns of overbuilding had a negative impact on share prices late last year, demand for capacity is continuing to keep pace. As the global economy becomes more tech-dependent growth in and evolution of data centers is fundamentally necessary to the equation.

A slow-down in the economy would likely reduce the number of smaller constituents entering the data center market and allow the larger public REITs an opportunity to acquire and develop additional assets at a discount. Growth in internet traffic and data usage is not directly tied to the business cycle but is more closely linked to the continued evolution of technology.

Vertical integration is the biggest threat to data centers, which is why the proximity of colocations and interconnections are especially important and valuable to data center REIT portfolios. (REIT Institute, 2019) REITs can scale to meet the needs of customers and offer access to colocations and interconnections more cost-effectively than managing internally. The REITs continue to strategically grow their internal architecture of interconnections to add value to their customers, and to differentiate their portfolios from the smaller, less advanced competitors entering the market.