Any intelligent investor knows that there’s no such thing as a completely safe investment. That’s not necessarily a bad thing. Because contrary to what most people think, saving money instead of investing is a guaranteed risk. If you keep a million dollars in the bank and allow interest to make it grow, you’re actually losing money against inflation.

But I assume, you know that by now.

You know that you have to give your money some room for growth. You know that the room for growth also comes with risks.

Nevertheless, you also don’t want to gamble away your hard-earned money. The key to safe investments is to know how much risk you’re willing to take. And then, learn to manage these risks to prevent incurring losses.

Key Takeaways

- Investing in REITs is for the moderately aggressive to aggressive investors.

- REITs have a more stable cash flow because they collect rental payments as long as the lease contract is in force.

- A REIT company with an excellent credit rating — at least BBB- or Baa3 — has the lowest level of risk for investors.

- Public REIT companies registered under the SEC are the safest to invest in because the company’s financial status gets reported regularly to the investors.

- Private and non-traded REIT companies require a holding period on their investments. Liquidation through repurchasing of shares is also not guaranteed.

- Generally, mREITs pay out higher dividends compared to equity REITs. But it is riskier because mREITs use the power of leverage (borrowed capital) through debt financing.

- Diversified REITs are safer to invest in because they have other sources of income in case one sector is not performing well. However, specialized REITs are also safe as long as they have an economic advantage like the health care, self-storage, infrastructure, and data center sectors.

- When looking at the REIT’s financials, positive Net Income and AFFO are preferable. The payout ratio should also be well above 100% and the Net Debt-to-EBITDA ratio below 6.

- Some examples of the safest REITs to invest in are American Assets Trust, Inc. (diversified), American Tower (infrastructure), and Public Storage (self-storage).

Risk vs. Reward

Out of the many choices of investment vehicles, how do you know which one to venture into? You have to know your risk tolerance — the willingness of an investor to take certain risks on their current wealth for future gains.

Take a look at the Investment Pyramid below.

REITs are categorized under “real estate investment properties”, which is located in the upper-middle section of the Investment Pyramid. When it comes to investment gains and losses, there is an inverse relationship between risk and reward. The higher you go up the Investment Pyramid, the higher potential for gains or rewards. However, on the flip side, there are also greater risks. Investing in REITs is for the moderately aggressive to aggressive investors.

To understand the risk vs. reward concept in investing, let’s compare investing between bonds and real estate:

- In bonds, investors get a steady stream of income from the interest of their investments. On its maturity date, the principal amount will also be given back. The risks are almost non-existent, especially with government bonds. You can only lose your money if the government goes bankrupt — which is unlikely because the government always collects taxes.

- Real estate naturally hedges against inflation, because the worth of properties and rental payments can increase with time. However, market recessions happen about every 4 years. And when they happen, demand decreases for real estate. Huge losses in the properties’ market value and rental cash flow may be incurred.

Bonds and real estate are on the opposite sides of the spectrum. Bonds are for conservative investors, while real estate are for aggressive investors. If you still want to invest in real estate but with lesser risks, then REIT investing will be a perfect fit.

So if you want to know how to find the safest REITs to invest in, you must know what risks to look out for.

What are the Risks in REIT Investing?

Every investment faces the same risk categories. They only differ in the extent of uncertainties.

For REITs, here are the risks you should know.

1.Market risk

REITs that are listed in public exchanges such as NASDAQ and NYSE have similar market risks with stocks (or equity shares). They are also subjected to market volatility due to several reasons — e.g. economic recessions, natural disasters, and market psychology.

However, stocks are more volatile compared to REITs because businesses come and go. Real estate, on the other hand, has a more stable cash flow because of lease contracts. Even if there are economic downturns, REITs still collect rental payments as long as the contract is in force. REITs are also legally required to pay out at least 90% of their taxable income to their investors.

2.Liquidity Risk

Publicly traded REITs are liquid. You can sell your shares in the exchange and within minutes, the shares can be bought by fellow investors.

Non-traded REITs are not. Private and non-traded REIT companies require a holding period on their investments. You can request to sell your shares, but there’s no guarantee whether the REIT company will repurchase them. Even then, there may be chances where the profit returned will be less than what you intended to sell.

3.Concentration Risk

A fundamental investing tip for all investors — “Don’t put your eggs in one basket.”

Diversification is the key if you want to invest in safe REITs. REITs can be classified according to their type of assets, how they’re traded, and their specialization by sector. You can read more about that in Types of REITs.

NAREIT has released their REIT Industry Fact Sheet where public U.S. REITs were classified according to 13 sectors. The largest market capitalization among the sectors are the infrastructure and residential sectors.

The chart above also shows the corresponding percent dividend yield for each sector. Diversified REITs had one of the highest dividend yields among the equity REITs. As expected, the lodging/hotel industry was affected the most by the COVID-19 pandemic with only a 0.05% dividend yield. The highest dividend yield (8.41%) was from mortgage REITs. Although, mortgage REITs have a greater risk because of their debt financing nature (more on this later).

4.Credit Risk

Every company incurs debts to leverage on their investments. However, you should also take note of their credit rating. A good credit rating tells you that a company is responsible when it comes to paying off debts. The general rule is — the higher the credit rating, the safer the REIT.

There are 3 credit rating agencies that you can refer to — Moody’s, Fitch, and S&P.

A REIT company with an excellent credit rating has the lowest level of risk for investors. Look for REIT companies that have at least BBB- or Baa3 credit rating.

5. Reinvestment Risk

Reinvestment risk is when an investor could not find another investment that gave him the same level of returns from the previous one. This type of risk may not be significant to REITs because they are legally obligated to pay out 90% of their taxable income as dividends back to their investors.

Although, mortgage REITs are more affected by this than equity REITs — especially when interest rates change. When interest rates increase, REITs tend to perform poorly historically.

6. Inflation Risk

Real estate assets have an advantage over stocks and bonds when it comes to hedging the inflation rate. By nature, the value of real estate properties grows with time — unless during market recessions. But in the long term, real estate investing offers lucrative returns. Even if the real estate market is not doing well overall, the property managers can just raise their rents to compensate for the decline in demand.

As shown in the chart above, the growth of REIT dividends extensively outpaced the inflation rates, except during market recessions. These were during the Dot Com Bubble in the early 2000s, the Great Recession between 2007 to 2009, and the COVID-19 pandemic in 2020.

How to Manage Risks

These are the following criteria for choosing safe REITs to invest in:

Public and Exchange-Traded > Public and Non-Traded > Private

Private REITs are the riskiest REITs to invest in because they are not required to release financial reports. They are also not required to disclose their investment portfolio. They’re usually bought by accredited investors in crowdfunding sites or private placements.

Public companies registered under the SEC are the safest to invest in. They provide annual and quarterly reports to regularly update the investors on how their investments are doing. That way, it’s easier for investors to conduct research and do their due diligence. The market is easily accessible to public and retail investors.

Public, non-traded REITs are somewhere in between. They release financial reports to the public, but the market is not easily accessible. You’ll have to meet the suitability criteria to enter through brokers or secondary markets. If you want to exit, you’ll also have to wait for the company’s approval to repurchase your shares for liquidation.

Other factors that make private and non-traded REITs riskier are:

- It’s more challenging to determine the value of REIT shares because of limited information.

- Suitability criteria are more stringent requiring hefty minimum investments.

- Upfront and commission fees will also take a huge chunk out of your total returns.

- Repurchasing of shares can be done by the REIT company only. It is subject to approval and thus does not guarantee anything.

- Dividends are also not guaranteed.

- Investments may be subjected to a certain holding period.

Equity REITs > Mortgage REITs

Equity REITs own or manage the daily operations of its real estate properties. They get their revenue by leasing out units to tenants and collecting rental payments.

Mortgage REITs (mREITs) invest in mortgages, mortgage-backed securities, and other related assets. They do not directly own real estate assets. Rather, they collect principal and interest income from the mortgage holders. When mortgage holders default on their loans, the foreclosed houses can be seized by the REIT company.

Going back to the previous NAREIT REITs by Sector chart, equity REITs’ dividend yields only range between 0.05% to 4.9%. Whereas, mortgage REITs almost doubled to 8.41%. Generally, mREITs pay out higher dividends compared to equity REITs. This is because mREITs use the power of leverage (borrowed capital) through debt financing.

Remember — risk and reward have an inverse relationship. The potential of higher rewards of mREITs may be appealing. But if the market behaves unfavorably, the leveraging power can backfire. So if you prefer safer investments, it’s best to stick with equity REITs.

Diversified > Concentrated

Diversified REITs are safer to invest in because they have other sources of income in case one sector is not performing well. For example, Blackstone REIT has investments in Hyatt and Marriott hotels. Even if the hotel occupancy rates are low because of travel restrictions, they still have residential, industrial, retail, office, and self-storage assets.

However, other investment strategies may look at it from a different perspective. For others, companies that specialize in one sector build a stronger reputation over the specific industry. They may attract the market because of their strong branding and authority. Just make sure that the sector has a moat or a competitive economic advantage.

For example, the lodging sector doesn’t have an economic advantage due to its seasonal availability. Compare that to the health care sector which has high occupancy rates because it’s a common necessity no matter what the circumstances are. Another sector with a moat is the residential sector — people will always want to have a roof above their heads.

Investing in emerging or booming markets is also a good idea. Data center and infrastructure sectors are on-demand today especially when people rely on remote communication and cloud databases.

Financial Parameters

Lastly, the most important criteria you should look at are the financial statements of the REIT companies. With public REITs, financial reports can be accessed from their company website or directly from the SEC website.

Net Income/Loss

This parameter eliminates all the property operation expenses (e.g. maintenance, insurance, and taxes), depreciation, and amortization from the total revenue. It tells us how much the take-home pay of the company is.

Adjusted Funds from Operations (AFFO)

Depreciation, amortization, and gains/losses on property sales are deducted from the net income. But the value of real estate assets usually appreciate with time. AFFO gives a better perspective on the company’s earnings than net income. AFFO is net income plus depreciation, amortization, and losses/gains in property sales; less capital expenditures. If AFFO is greater than the net income, it means that the company earned more from its operations.

Dividend Payout Ratio

It tells us how much of the company’s net income is paid back to its investors in the form of dividends.

Net Debt-to-EBITDA Ratio

According to Corporate Finance Institute, this ratio tells credit rating agencies how long the company would need to operate in the current situation to pay off all debt. The lower the ratio, the better.

Let’s take a look at an example:

| Whitestone REIT’s Financial Statement Parameters as of FY 2020 | |

| Net Income | $6M |

| AFFO | $36.4M |

| Dividend Payout Ratio | 417.68% |

| Net Debt | $633.7M |

| EBITDA | $59.2M |

| Net Debt-to-EBITDA Ratio | 10.7 |

Source: Seeking Alpha

Whitestone REIT owns and manages retail and office spaces. As of FY 2020, their FFO is $36.4M, which is 6x greater than the reported net income. Much of the company’s earnings are given back to the investors as dividends with a payout ratio of 417.68%. REIT companies usually pay more than 100% of their taxable income if they have good cash flow.

However, you also have to look out for Whitestone’s credit risk. Its Net Debt-to-EBITDA ratio is higher than the general standard. The acceptable ratio is 6 or lower. Make sure to compare it with its industry peers since the general rule also varies per sector.

3 Examples of Safe REITs to Buy in 2021

With that in mind, here are some examples of the safest REITs to buy in 2021. Take note that this shouldn’t be regarded as investment advice or recommendation. Rather, it’s for educational purposes only.

1.American Assets Trust, Inc. (NYSE: AAT)

Among the 21 public diversified REITs associated with NAREIT, the American Assets Trust, Inc. (AAT) has one of the lowest Net Debt-to-EBITDA ratios (~6) for FY 2020. As such, they have good credit ratings — BBB (Fitch rating), Baa3 (Moody’s rating), and BBB- (S&P rating). Their investment portfolio is distributed across 3 sectors — office, retail, and residential.

As for their financials, both Net Income and AFFO were positive and increasing (except for 2020). Despite the COVID-19 pandemic, there were no net losses. They consistently pay dividends quarterly — all of which were above 100% payout ratio.

2. American Tower (NYSE: AMT)

Even though American Tower’s investment portfolio is concentrated in the infrastructure sector only, they’re still safe to invest in because there is a strong demand for better connectivity. Something that’s magnified even more with the COVID-19 pandemic.

As businesses and world governments adapt to remote work set-ups, increasing competition in wireless connections calls for higher bandwidth. With the rollout of the latest 5G technology, American Tower positions itself as a global leader in the industry.

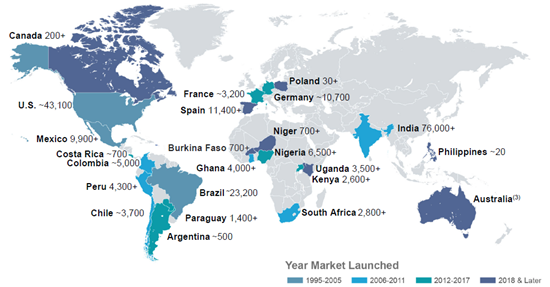

As one of the largest global REITs, they are present in 6 continents with approximately 186,000 communication sites as shown in the map below.

As for its financials, the direction of the earnings growth is going upwards generally. Although, the payout ratio may sometimes slightly dip below 100%.

Despite the Net Debt-to-EBITDA ratio exceeding 6 in FY 2019 and FY 2020, American Tower still has a stable credit rating — BBB+ (Fitch rating), Baa3 (Moody’s rating), and BBB- (S&P rating).

3. Public Storage (NYSE: PSA)

Public Storage also has a concentrated investment portfolio in self-storage facilities. The self-storage sector has a recession-proof business model. As long as there is death, dislocation, divorce, and downsizing (also referred to as the 4Ds), there will always be a need to move and store belongings. Besides, there are fewer operating expenses to think about which maximizes the profit.

PSA has an excellent credit rating — an A2 Moody rating and an A S&P rating. The Net Debt-to-EBITDA ratios were also approximately 1 or lower — proving that PSA has low credit risk and thus, is safe to invest in.

Bottomline

REITs are designed to produce stable income for investors through dividend payouts. They’re relatively safer compared to other investment vehicles like growth stocks, futures, crypto, and real estate investing. But there are still risks that you have to learn how to manage.

Always remember:

- The safer REITs to invest in are the public and listed REITs in stock exchange markets.

- Diversified equity REITs will hedge you against economic cycles, but so will some sectors that have a unique advantage. Some examples would be health care, infrastructure, data center, and self-storage sectors.

- Lastly, conduct due diligence by looking at the REIT companies’ financial statements. REIT companies with positive Net Income and AFFO are preferable. A Low Net Debt-to-EBITDA ratio also signifies an excellent credit rating. That’s another strategy to reduce incurring credit risks.